8 Tips to Master eBay Sales Tax Calc Effortlessly

On the surface, eBay sales tax calculation might appear as a straightforward feature driven primarily by regulatory compliance, but its roots delve far deeper into the evolution of online commerce, taxation doctrines, and digital infrastructure. As e-commerce expanded exponentially through the early 2000s, the complexities of sales tax—traditionally confined within state and local jurisdictions—began to infiltrate the virtual domain, demanding innovative solutions from marketplace platforms. Understanding the origins and ongoing transformation of sales tax legislation reveals the meticulous efforts needed to master eBay's sales tax calculation, turning what seems a mundane task into a strategic asset for sellers worldwide.

The Evolution of Sales Tax in the Digital Age: From Brick-and-Mortar to E-Commerce

Historically, sales tax has been a local phenomenon, with each state defining its tax parameters based on its legislative history. Before the digital revolution, physical stores collected taxes at the point of sale, remitting these to specific jurisdictions. This system functioned well within finite geographic boundaries, but the advent of online marketplaces like eBay broke those geographic boundaries wide open. Sellers, often located far from their buyers, struggled to navigate the fragmented tax landscape.

The landmark case of South Dakota v. Wayfair, Inc. in 2018 profoundly shifted the landscape. This Supreme Court decision overturned the long-held physical presence standard established by Quill Corp. v. North Dakota in 1992, permitting states to impose sales tax obligations on remote sellers exceeding certain thresholds, regardless of physical location. Consequently, platforms like eBay had to develop robust, automated tax calculation systems capable of complying with over 40 states and hundreds of local jurisdictions in the U.S. alone, each with its own rules and exemption statuses.

Alongside legislative changes, technological innovations like real-time data integration, geolocation techniques, and dynamic tax rate databases became pivotal. These developments undergird the shift from manual, often error-prone tax estimation methods to sophisticated, compliant automation—integral for seller success in today’s e-commerce ecosystem.

Current Landscape: The Intersection of Legislation, Technology, and Marketplace Logistics

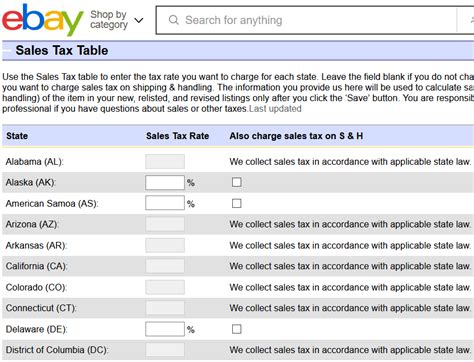

The modern approach to sales tax calculation on eBay exemplifies a fusion of legal compliance, technological sophistication, and logistical efficiency. Sellers navigating this complex environment must grasp key concepts such as nexus, economic thresholds, and exemption certificates, while leveraging advanced tools to streamline the process.

eBay’s platform itself has evolved into a dynamic ecosystem that integrates third-party services such as Avalara, TaxJar, and others to facilitate automatic tax calculations based on buyer location, product category, and applicable exemptions. These integrations exemplify a significant shift: moving from manual input to real-time, data-driven algorithms that adjust for jurisdictional variability seamlessly.

This landscape is further complicated by the variety of product classifications—some items are taxable, others are exempt or subject to different rates—and the diverse array of delivery options and fulfillment models, which influence nexus determinations. The continuous legal updates and tax rate changes necessitate an agile, responsive system, underlining the importance of ongoing vigilance and strategic adaptation by eBay sellers.

Mastering eBay Sales Tax Calculation: 8 Expert-Driven Tips

Key Points

- Tip 1: Understand your nexus obligations—each state’s thresholds determine when you must collect sales tax regardless of physical presence.

- Tip 2: Leverage reliable automation tools—integrate trusted third-party solutions to ensure real-time, compliant tax calculations across jurisdictions.

- Tip 3: Regularly update your knowledge of tax law changes—stay informed via official state tax sources or professional advisories to avoid penalties.

- Tip 4: Categorize your products accurately—knowing which are taxable or exempt prevents costly miscalculations and audit risks.

- Tip 5: Incorporate geolocation data—use IP or GPS-based solutions to verify buyer locations precisely, reducing errors in taxing based on incorrect locations.

- Tip 6: Maintain detailed exemption records—collect and store exemption certificates where applicable to justify tax-free sales in audits.

- Tip 7: Configure your eBay store settings meticulously—ensure your tax collection preferences align with the latest legal requirements and your business model.

- Tip 8: Educate your team and stay proactive—training staff involved in order processing and tax management minimizes compliance risks and enhances operational efficiency.

A Technical Deep-Dive: Implementing Advanced Sales Tax Strategies on eBay

For sellers aiming to elevate their compliance game, diving into the technicalities reveals a layered architecture centered on data accuracy, automation, and proactive management.

Geolocation Techniques and Data Accuracy

Geolocation technology has become indispensable in verifying buyer addresses, especially in cross-border sales or when buyers use VPNs or proxy servers. Integrating APIs from providers like Google Maps or IPinfo ensures that tax jurisdictions are accurately assigned, reducing the risk of audit or penalty. Moreover, continuous validation—using multiple data points—creates a resilient system resilient to fraudulent or erroneous data inputs.

| Relevant Category | Substantive Data |

|---|---|

| Geolocation Accuracy | Over 95% success rate when combining IP-based and GPS-based data verification, according to recent industry reports |

Tax Rate Databases and API Integration

The backbone of seamless compliance involves integrating real-time tax rate APIs into eBay’s marketplace backend, allowing instant updates with legislative changes. Developers must ensure these APIs are reliable, covering all applicable jurisdictions and products, and are periodically tested for accuracy. The use of conditional logic, such as applying different rates for product categories or shipment methods, refines this process further.

Handling Exemptions and Special Cases

Exemption management requires meticulous data collection and storage. When a buyer presents a certificate or qualifies for tax-exempt status, sellers need a digital repository that can handle multiple exemption types, including resale permits, non-profit exemptions, or government entities. These records should be linked directly to transaction data for transparent, auditable processes.

Challenges and Limitations in Sales Tax Automation

Despite technological advances, certain hurdles persist. Variability in legal interpretations, lag in legislative updates, and the complexity of multi-state and international tax treaties challenge even sophisticated systems. For instance, recent shifts toward economic nexus standards threaten to outpace current automation capabilities, necessitating continuous system updates. Additionally, international sales introduce VAT, GST, and other indirect taxes, complicating systems designed primarily for pure sales tax environments.

Moreover, the costs associated with integrating and maintaining high-fidelity tax compliance infrastructure can be significant for smaller sellers, creating a divide between those able to afford robust solutions and those relying on manual methods—posing an ongoing risk management dilemma.

Future Outlook: Innovation and Strategic Adaptation

The future of sales tax calculation on eBay hinges on artificial intelligence, blockchain, and data analytics—technologies that promise to enhance accuracy, transparency, and ease of compliance. Predictive analytics may forewarn sellers of upcoming legislative changes based on legislative trends, while blockchain can secure exemption and tax data, making transactions tamper-proof and auditable.

Furthermore, international cooperation may pave the way for a standardized global sales tax framework, reducing the complexity of jurisdictional variances. Sellers who adopt early and adapt their operational architectures accordingly will enjoy competitive advantages, facilitating effortless compliance and empowering growth.

Summary: Navigating the Complex Web of eBay Sales Tax Calculations

From its origins rooted in state and local taxation to the sophisticated, AI-driven systems today, sales tax calculation exemplifies the interplay between legislative evolution, technological innovation, and market dynamics. Mastery requires not only understanding legal thresholds, exemptions, and jurisdictional nuances but also implementing agile, data-driven solutions that respond to ongoing legislative shifts. For eBay sellers committed to compliance and operational excellence, embracing this intricate landscape unlocks opportunities for growth and mitigates risks inherent in the digital economy’s rapid pace.

How does eBay automatically calculate sales tax for my orders?

+eBay integrates with third-party tax automation services that access up-to-date jurisdictional rates and apply them based on buyer location, shipment method, and product category, ensuring compliance with applicable laws in real time.

What should I do if I sell internationally on eBay?

+International sales often involve VAT, GST, or other local taxes. You should incorporate international tax compliance tools, understand local tax laws, and consider consulting with tax professionals to manage these obligations effectively.

Can I override eBay’s automatic sales tax calculations?

+While eBay allows seller-set tax rates in some circumstances, it is recommended to rely on automated calculations for compliance. Overrides may pose audit risks if not properly documented and justified.

How often should I review my sales tax setup on eBay?

+Regular reviews—quarterly or after legislative changes—are advised to ensure your tax settings remain accurate and compliant, minimizing potential penalties and maximizing operational efficiency.