Doordash Tax Forms

Doordash, the popular food delivery platform, has revolutionized the way we order and receive our meals. As a gig worker or an independent contractor for Doordash, understanding your tax obligations is crucial. This comprehensive guide will delve into the world of Doordash tax forms, exploring the various documents you need to file and providing valuable insights to ensure a smooth tax season.

Navigating the Doordash Tax Landscape

Doordash, like many gig economy platforms, offers flexibility and freedom to its Dashers, but it also comes with tax responsibilities. As a Dasher, you are considered a self-employed worker, and your earnings are subject to various taxes. Staying informed and organized is key to a stress-free tax journey.

Key Tax Forms for Doordash Dashers

To comply with tax regulations, Dashers need to be familiar with the following tax forms:

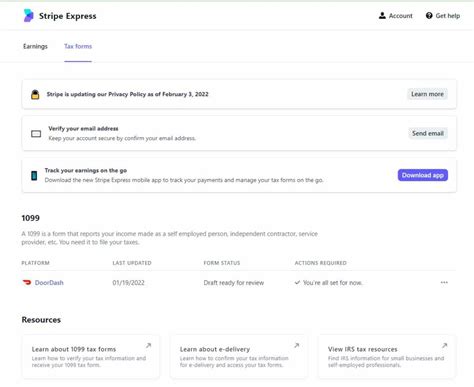

- Form 1099-K: Payment Card and Third Party Network Transactions - This form is crucial as it reports the total payment card and third-party network transactions made through Doordash to the IRS. It provides a detailed breakdown of your earnings, making it a vital document for tax filing.

- Form 1099-NEC: Non-Employee Compensation - Issued by Doordash, this form reports the total amount of non-employee compensation paid to you during the tax year. It ensures that your income from Doordash is accurately reported to the tax authorities.

- Form W-9: Request for Taxpayer Identification Number and Certification - As a Dasher, you will need to complete and provide a W-9 form to Doordash. This form contains your taxpayer identification number (TIN) and other relevant details, helping Doordash comply with tax reporting requirements.

Understanding Your Tax Obligations

As a self-employed Dasher, you are responsible for paying taxes on your earnings. This includes:

- Income Tax - You must calculate and pay federal and state income taxes on your Doordash earnings. The tax rate depends on your income bracket and the specific tax laws in your jurisdiction.

- Self-Employment Tax - This tax covers Social Security and Medicare contributions. As a self-employed individual, you are responsible for both the employer and employee portions of these taxes.

- Sales Tax - If you deliver items subject to sales tax, you may need to collect and remit sales tax to the appropriate authorities. It’s important to stay updated on sales tax regulations in your state or region.

Tracking Your Earnings and Expenses

To accurately report your taxes, it’s essential to maintain a meticulous record of your earnings and expenses related to your Doordash activities. Consider using a dedicated bookkeeping app or software to track:

- Delivery fees and earnings.

- Mileage and vehicle expenses.

- Phone and data plan costs.

- Maintenance and repair expenses for your delivery vehicle.

- Any other business-related expenses.

Keeping detailed records will not only simplify your tax filing process but also help you maximize your deductions, potentially reducing your tax liability.

| Expense Category | Deduction Potential |

|---|---|

| Mileage | Use the IRS standard mileage rate or actual expense method to claim deductions. |

| Vehicle Maintenance | Include oil changes, repairs, and tires. |

| Phone and Data Plan | Proportionate to business usage. |

| Delivery Supplies | Bags, containers, and other delivery essentials. |

Filing Your Taxes: A Step-by-Step Guide

When tax season arrives, follow these steps to ensure a smooth filing process:

- Gather all relevant tax forms from Doordash, including Form 1099-K and Form 1099-NEC.

- Organize your records and calculate your total income and expenses for the tax year.

- Determine your deductions and prepare your tax return using tax preparation software or seek professional assistance from a tax advisor or accountant.

- File your tax return electronically or by mail, ensuring all forms are completed accurately.

- Consider paying your taxes in installments if you anticipate a large tax bill.

Tips for Tax Savings

Maximizing your tax savings as a Doordash Dasher involves careful planning and awareness of available deductions. Here are some strategies to consider:

- Home Office Deduction - If you have a dedicated home office space used exclusively for Doordash work, you may be eligible for a home office deduction. This can significantly reduce your taxable income.

- Vehicle Expenses - Keep detailed records of your vehicle expenses, including mileage, fuel, and maintenance. Consider using the IRS standard mileage rate or actual expense method to maximize your deductions.

- Health Insurance Premium Deduction - If you purchase health insurance as a self-employed individual, you may be able to deduct a portion of your premiums as a business expense.

- Meal and Entertainment Expenses - When you meet clients or potential business partners for meals, you may be able to deduct a portion of the cost as a business expense. However, these deductions are subject to specific rules and limitations.

The Future of Doordash Tax Compliance

As the gig economy continues to evolve, tax regulations are also expected to adapt. Doordash, along with other gig platforms, is actively engaging with policymakers and tax authorities to establish clear guidelines for tax compliance. Stay informed about any updates or changes in tax laws that may impact your Doordash earnings.

Conclusion: Empowering Dashers for Tax Success

Understanding and navigating the tax landscape as a Doordash Dasher is essential for financial success and peace of mind. By staying organized, keeping accurate records, and seeking professional guidance when needed, you can ensure a seamless tax experience. Embrace the flexibility and freedom of the gig economy while staying on top of your tax obligations.

What if I don’t receive a Form 1099-K from Doordash?

+If you don’t receive a Form 1099-K, it’s important to contact Doordash’s support team to verify your earnings and request the necessary tax forms. You can also use your own records to calculate your earnings and report them accurately on your tax return.

Are there any tax benefits for Dashers who use electric vehicles?

+Yes, Dashers who use electric vehicles may be eligible for tax credits and deductions. These incentives can reduce your taxable income and help offset the cost of purchasing and maintaining an electric vehicle. Check with a tax professional for specific guidelines.

Can I deduct the cost of my smartphone as a business expense?

+Yes, you can deduct a portion of your smartphone costs as a business expense. This includes the phone itself, as well as the data plan and any accessories used specifically for Doordash deliveries. Keep records of your expenses and calculate the proportionate business usage to claim this deduction accurately.