Does Indiana Have State Income Tax

The state of Indiana, nestled in the heartland of the United States, has a robust tax system that contributes significantly to its economic landscape. Among the various taxes it imposes, one of the most notable is the state income tax, which plays a pivotal role in funding public services and infrastructure projects across the state.

Indiana’s State Income Tax Structure

Indiana’s income tax system is designed to ensure a fair and equitable contribution from its residents and businesses. It operates on a progressive tax structure, meaning the tax rate increases as income levels rise. This approach aims to distribute the tax burden proportionally across different income brackets.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $2,600 | 2.4% |

| $2,601 - $10,400 | 3.2% |

| $10,401 - $25,000 | 3.3% |

| $25,001 and above | 3.23% |

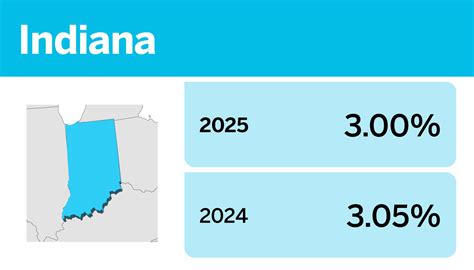

As of my last update in January 2023, Indiana's income tax rates were as follows. These rates are applied to taxable income, which may differ from gross income due to various deductions and exemptions.

Taxable Income Categories

Indiana categorizes taxable income into several brackets, ensuring a progressive taxation system. The income ranges and corresponding tax rates are designed to accommodate different earning levels. For instance, individuals earning up to 2,600 are taxed at a lower rate of 2.4%, while those with higher incomes face a slightly higher rate of 3.23% for incomes above 25,000.

Filing and Payment Process

Indiana residents and businesses are required to file their income tax returns annually. The filing deadline typically aligns with the federal tax deadline, which is usually April 15th. However, it’s crucial to note that in the event of a conflict, Indiana’s tax laws prevail. Late filing and payment may incur penalties and interest, so it’s essential to adhere to the state’s tax calendar.

Indiana offers various payment methods, including direct deposit, credit/debit cards, electronic funds transfer, and traditional check or money order. Online filing is available through the state's official website, providing a convenient and efficient means for taxpayers to fulfill their obligations.

Comparative Analysis with Other States

When compared to other states, Indiana’s income tax structure stands out for its simplicity and moderate tax rates. Unlike some states that have flat tax rates, Indiana’s progressive system ensures that higher-income earners contribute a larger proportion of their income to state revenues. This approach aligns with the principle of tax fairness, ensuring those with greater means contribute more to the state’s finances.

In comparison to neighboring states, Indiana's income tax rates are relatively competitive. For instance, Kentucky has a flat income tax rate of 5%, while Ohio operates with a progressive system similar to Indiana's, albeit with slightly different income brackets and tax rates. These variations in tax structures reflect the unique economic policies and priorities of each state.

Impact on Economic Climate

Indiana’s income tax policy has a significant influence on the state’s economic climate. The progressive tax structure, combined with competitive rates, contributes to a business-friendly environment. This encourages economic growth, attracts investment, and fosters job creation. By maintaining a balance between taxation and economic incentives, Indiana strives to support its businesses and residents while also funding essential public services.

State Revenue and Budget Allocation

Income tax forms a substantial portion of Indiana’s state revenue, alongside other sources such as sales tax, corporate tax, and property tax. This revenue is critical for funding public services, including education, healthcare, infrastructure development, and public safety initiatives.

The state's budget allocation process involves careful consideration of various factors, such as population demographics, economic trends, and public needs. The revenue generated from income tax is distributed across different sectors to ensure efficient and effective governance. This process is overseen by the state's legislative and executive branches, ensuring transparency and accountability in the allocation of public funds.

Tax Relief and Exemptions

Indiana recognizes the need for tax relief and offers various exemptions and credits to ease the tax burden on specific groups. For instance, the state provides a standard deduction that reduces taxable income for all taxpayers. Additionally, there are provisions for dependent exemptions, which reduce taxable income based on the number of dependents a taxpayer supports.

Furthermore, Indiana offers tax credits for various expenses, such as education, childcare, and certain medical costs. These credits further reduce the tax liability for eligible taxpayers, providing much-needed relief and supporting specific state initiatives. By offering these exemptions and credits, Indiana aims to promote economic stability and provide targeted support to its residents.

Future Outlook and Potential Changes

The landscape of taxation is dynamic, and Indiana, like other states, continuously assesses its tax policies to adapt to changing economic conditions and public needs. As the state’s economy evolves, so too might its tax structure.

One potential area of focus is the exploration of tax incentives to attract specific industries or promote economic development in targeted regions. Additionally, the state might consider adjustments to its tax brackets and rates to ensure the system remains fair and competitive in the evolving economic landscape. These changes could impact not only income tax but also other forms of taxation, such as sales tax and corporate tax.

Conclusion

Indiana’s state income tax plays a crucial role in funding public services and shaping the state’s economic landscape. With a progressive tax structure and competitive rates, Indiana aims to create a balanced and fair taxation system. The state’s approach to taxation, combined with its thoughtful budget allocation and tax relief measures, contributes to a thriving economic environment while ensuring the well-being of its residents.

As Indiana continues to adapt and evolve, its tax policies will remain a key factor in shaping the state's future. By staying informed and engaged with these policies, residents and businesses can navigate the tax landscape effectively and contribute to Indiana's ongoing prosperity.

FAQ

How often must I file my income tax in Indiana?

+

Indiana residents and businesses are required to file their income tax returns annually. The filing deadline typically aligns with the federal tax deadline, which is usually April 15th. However, it’s crucial to stay updated on any changes or extensions that may be announced by the state.

What happens if I miss the filing deadline for my Indiana income tax return?

+

Late filing of your Indiana income tax return may result in penalties and interest charges. It’s essential to adhere to the filing deadline to avoid these additional costs. However, if you anticipate being unable to meet the deadline, it’s advisable to request an extension from the Indiana Department of Revenue.

Are there any tax relief programs available for low-income earners in Indiana?

+

Yes, Indiana offers several tax relief programs to assist low-income earners. These programs include the Low Income Tax Credit and the Property Tax Deduction, which provide financial relief to eligible individuals and families. It’s recommended to consult the Indiana Department of Revenue’s website for detailed information on these programs and their eligibility criteria.