Does Arkansas Have A State Tax

The taxation landscape of the United States is diverse, with each state having its own set of tax laws and regulations. One state that often sparks curiosity is Arkansas, a state known for its natural beauty and vibrant culture. When it comes to state taxes, Arkansas follows a specific set of rules and structures to generate revenue and fund various public services and initiatives.

Understanding Arkansas State Taxes

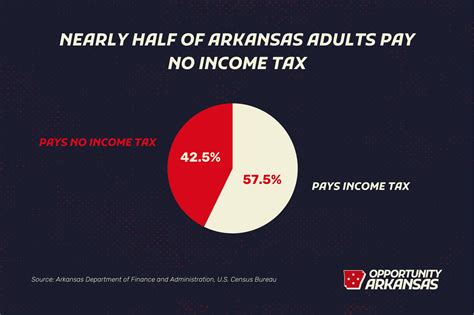

Arkansas, like many other states, imposes a state income tax on its residents and businesses. This income tax forms a significant part of the state's revenue stream and is used to support a wide range of public services, including education, healthcare, infrastructure development, and more. The state's tax system aims to promote fairness and ensure that individuals and businesses contribute to the overall growth and development of the state.

The Arkansas state tax system is structured to cater to different income levels and types of entities. For individuals, the state income tax is based on a progressive tax rate, meaning the tax rate increases as income levels rise. This approach aims to ensure that higher-income earners contribute a larger share of their income to the state's revenue, fostering a more equitable distribution of tax burden.

Income Tax Rates and Brackets

Arkansas has established a series of income tax brackets, each with its corresponding tax rate. As of the 2023 tax year, these brackets and rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $2,100 | 1.0% |

| $2,100.01 - $3,500 | 2.0% |

| $3,500.01 - $4,800 | 3.0% |

| $4,800.01 - $6,700 | 4.0% |

| $6,700.01 - $9,300 | 5.0% |

| $9,300.01 and above | 6.5% |

These tax brackets are applicable to both single and joint filers. It's important to note that the state tax rates are subject to change periodically, so it's advisable to refer to the most recent tax guidelines issued by the Arkansas Department of Finance and Administration for the most accurate and up-to-date information.

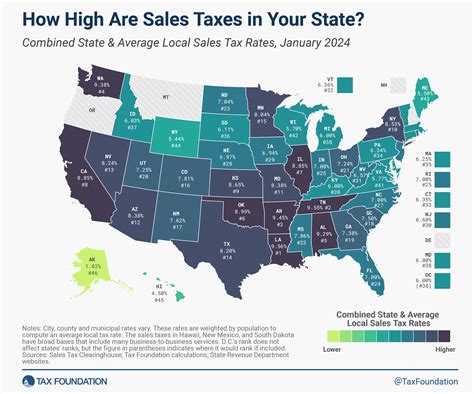

Sales and Use Tax

In addition to income tax, Arkansas imposes a sales and use tax on the purchase of goods and services within the state. The sales tax is collected by businesses at the point of sale and remitted to the state. The current sales tax rate in Arkansas is 6.5%, which includes both the state and local sales tax components.

Arkansas also has a use tax, which is applicable to purchases made outside the state but used within Arkansas. This tax ensures that individuals and businesses pay the appropriate tax on goods and services, regardless of where the purchase was made. The use tax rate is the same as the sales tax rate, ensuring consistency in taxation.

Other State Taxes

Arkansas, like many states, levies additional taxes on specific goods and services. These include taxes on alcohol, tobacco, and motor fuel. The rates for these taxes vary and are designed to generate revenue for specific purposes, such as funding healthcare initiatives or infrastructure projects.

For instance, the state imposes an excise tax on alcoholic beverages, with rates varying based on the type of alcohol. Similarly, there are specific taxes on tobacco products, including cigarettes, cigars, and smokeless tobacco. These taxes not only generate revenue but also serve as a deterrent to discourage the use of such products, contributing to public health initiatives.

Arkansas Tax Incentives and Exemptions

While Arkansas imposes various taxes, it also offers a range of tax incentives and exemptions to promote economic growth and support specific industries or initiatives. These incentives are designed to attract businesses, stimulate investment, and create jobs within the state.

Enterprise Zones

Arkansas has designated specific areas within the state as Enterprise Zones. These zones offer a range of tax incentives to businesses that locate or expand their operations within these areas. The incentives can include tax credits, exemptions, or reduced tax rates, depending on the zone and the nature of the business. Enterprise Zones are typically targeted at economically distressed areas, aiming to revitalize those regions through business growth and job creation.

Sales Tax Exemptions

Arkansas provides sales tax exemptions for certain types of purchases. These exemptions are designed to support specific industries or encourage certain behaviors. For instance, the state offers sales tax exemptions for certain agricultural equipment, manufacturing machinery, and materials used in research and development.

Additionally, there are exemptions for purchases made by non-profit organizations, educational institutions, and government entities. These exemptions help reduce the financial burden on these entities, allowing them to allocate more resources towards their core missions and services.

Tax Credits and Incentives for Businesses

Arkansas provides a variety of tax credits and incentives to encourage business growth and investment. These incentives can take many forms, such as tax credits for job creation, research and development activities, or investments in renewable energy projects. The state also offers tax incentives for businesses that locate or expand in specific industries, such as advanced manufacturing or technology.

One notable example is the Arkansas Economic Development Commission's (AEDC) Arkansas Advantage Program, which provides a range of incentives to businesses that meet certain criteria. These incentives can include tax credits, workforce training grants, and infrastructure improvements.

Tax Filing and Payment

For individuals and businesses, tax filing and payment in Arkansas are governed by specific guidelines and deadlines. The Arkansas Department of Finance and Administration provides detailed information and resources to assist taxpayers in understanding their obligations and ensuring compliance.

Income Tax Filing and Payment

Individual income tax returns in Arkansas are typically due by April 15th of each year. However, this deadline can be extended under certain circumstances. Taxpayers can file their returns electronically or by mail, depending on their preferences and the complexity of their tax situation.

Businesses, on the other hand, have different filing and payment deadlines depending on their entity type and tax obligations. For instance, corporations have quarterly estimated tax payment deadlines, while pass-through entities may have different reporting requirements. It's crucial for businesses to consult the relevant guidelines to ensure timely and accurate filing.

Sales and Use Tax Collection and Remittance

Businesses collecting sales tax in Arkansas are required to remit the collected tax to the state on a regular basis. The frequency of remittance can vary, with some businesses remitting monthly, quarterly, or annually, depending on their sales volume and other factors.

The state provides a user-friendly online system for businesses to file and remit sales tax returns. This system simplifies the process and ensures timely payment, reducing the administrative burden on businesses.

Compliance and Enforcement

The Arkansas Department of Finance and Administration takes tax compliance seriously and has established measures to ensure that taxpayers meet their obligations. The department employs a range of strategies, including education, outreach, and enforcement, to promote voluntary compliance and deter tax evasion.

Education and Outreach

The department provides extensive resources and educational materials to help taxpayers understand their tax obligations. These resources include guides, webinars, workshops, and online tools, ensuring that individuals and businesses have the knowledge and support they need to navigate the tax system effectively.

Enforcement Measures

While the department encourages voluntary compliance, it also has enforcement mechanisms in place to address non-compliance and tax evasion. These measures can include audits, penalties, and interest charges for late payments or underpayments. In severe cases of tax evasion, criminal charges may be pursued.

The department works closely with other state agencies and law enforcement to investigate and prosecute tax-related crimes, ensuring that the tax system remains fair and equitable for all taxpayers.

Arkansas State Tax: A Dynamic Landscape

Arkansas' state tax system is a dynamic and evolving landscape, influenced by various factors, including economic conditions, political decisions, and societal needs. The state continually evaluates its tax policies to ensure they remain effective, fair, and aligned with its goals for economic growth and public welfare.

As the state's economy and demographics change, so too do its tax policies. Arkansas strives to maintain a competitive tax environment while generating sufficient revenue to support essential public services and initiatives. This balance is crucial to ensuring the state's long-term prosperity and the well-being of its residents.

Staying informed about Arkansas' tax policies and keeping up-to-date with any changes is essential for individuals and businesses operating within the state. The Arkansas Department of Finance and Administration remains a valuable resource for the latest tax information, guidelines, and updates.

FAQs

What is the current state income tax rate in Arkansas for the 2023 tax year?

+

The state income tax rate in Arkansas for the 2023 tax year is progressive, ranging from 1.0% to 6.5% depending on the income bracket.

Are there any sales tax exemptions in Arkansas for specific purchases?

+

Yes, Arkansas offers sales tax exemptions for certain purchases, including agricultural equipment, manufacturing machinery, and materials used in research and development.

How often do businesses need to remit sales tax in Arkansas?

+

The frequency of sales tax remittance for businesses in Arkansas can vary based on sales volume and other factors. Some businesses remit monthly, quarterly, or annually.

What are the consequences for non-compliance with Arkansas state tax laws?

+

Non-compliance with Arkansas state tax laws can result in penalties, interest charges, and, in severe cases, criminal charges. The state encourages voluntary compliance through education and outreach.

Where can I find the latest information on Arkansas state tax policies and guidelines?

+

The Arkansas Department of Finance and Administration is the official source for the latest information on state tax policies and guidelines. They provide extensive resources and updates on their website.