Did Trump Abolish Income Tax

The idea of abolishing income tax is a controversial and highly debated topic, especially in the context of the Trump administration. While it is essential to examine the proposals and policies discussed during his presidency, it is crucial to clarify that President Donald Trump did not abolish income tax during his tenure in office.

However, the notion of tax reform and potential changes to the income tax system were central to Trump's campaign promises and his administration's agenda. Let's delve into the specifics of these proposals and the impact they had on the American tax landscape.

The Trump Administration’s Tax Reform Agenda

One of the signature initiatives of the Trump administration was the Tax Cuts and Jobs Act (TCJA), which was signed into law in December 2017. This comprehensive tax reform package aimed to stimulate economic growth, simplify the tax code, and provide tax relief to individuals and businesses.

The TCJA made significant changes to the income tax system, including:

- Reducing the number of tax brackets from seven to seven, with lower marginal tax rates across the board.

- Doubling the standard deduction, providing a substantial tax break for many Americans.

- Expanding the child tax credit, benefiting families with dependent children.

- Introducing a new pass-through deduction for certain businesses, reducing their tax liability.

- Limiting or eliminating several deductions, such as the state and local tax (SALT) deduction, which disproportionately affected high-tax states.

Impact of the Tax Cuts and Jobs Act

The TCJA had a profound impact on the American tax system, resulting in both positive and negative consequences. Here are some key aspects to consider:

| Impact | Description |

|---|---|

| Short-term Economic Boost | The tax cuts provided an immediate stimulus to the economy, leading to increased consumer spending and business investment. This contributed to a period of economic growth and a decline in unemployment rates. |

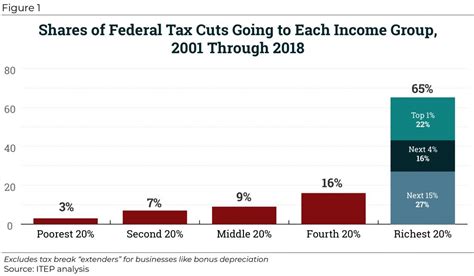

| Inequality Concerns | Critics argue that the TCJA disproportionately benefited high-income earners and corporations, exacerbating income inequality. The elimination of certain deductions and the reduction of tax rates favored those with higher incomes. |

| Long-term Sustainability | While the tax cuts were intended to boost economic growth, there were concerns about the long-term sustainability of the policy. The reduced tax revenue could lead to increased federal deficits and potential cuts to essential government programs. |

| State and Local Tax Impact | The limitation on the SALT deduction had a significant impact on high-tax states, such as California and New York. Residents in these states faced higher federal tax liabilities, sparking debates about state fiscal policies. |

Expert Insight: The Trump administration's tax reform efforts aimed to simplify the tax code and provide relief, but the long-term effects and distributional impacts of these changes are still being analyzed and debated by economists and policymakers.

The Future of Income Tax Policy

The conversation around income tax policy extends beyond the Trump administration. As the country navigates economic challenges and evolving political landscapes, the debate on tax reform remains active.

Proponents of tax reform argue for a more progressive tax system, aiming to address income inequality and provide greater social safety nets. On the other hand, those advocating for lower taxes believe in the power of economic incentives to drive growth and job creation.

The future of income tax policy will depend on the political dynamics, economic conditions, and the priorities of the American people. It is an ongoing discussion that shapes the nation's economic trajectory and the distribution of resources.

Key Considerations for the Future

- Income inequality and wealth distribution: Policymakers will need to address the growing gap between the rich and the poor, considering tax policies that promote a more equitable society.

- Sustainable revenue generation: Balancing tax cuts with maintaining fiscal responsibility is crucial to ensure the long-term solvency of the federal government.

- Global competitiveness: In a globalized economy, tax policies must attract investment and maintain competitiveness while also contributing to domestic priorities.

- Social programs and infrastructure: The allocation of tax revenue to essential services and infrastructure development will continue to be a critical aspect of tax policy discussions.

Expert Prediction: While it is challenging to predict the exact direction of income tax policy, the ongoing debates indicate a likelihood of further reforms. The next steps could involve a combination of targeted tax cuts, progressive tax increases, and efforts to streamline the tax code to enhance efficiency and fairness.

What was the primary goal of the Trump administration’s tax reform agenda?

+The Trump administration’s tax reform agenda, as embodied by the Tax Cuts and Jobs Act, aimed to stimulate economic growth, simplify the tax code, and provide tax relief to individuals and businesses.

Did the TCJA lead to increased tax revenue for the government?

+No, the TCJA resulted in a reduction of tax revenue for the federal government due to the tax cuts implemented. However, the administration argued that the economic growth stimulated by the tax cuts would offset this loss over time.

How did the TCJA impact middle-class taxpayers?

+The TCJA provided tax relief to many middle-class taxpayers by doubling the standard deduction and expanding the child tax credit. However, the elimination of certain deductions, such as the SALT deduction, had a disproportionate impact on high-tax states, affecting some middle-class families.