Dc State Tax

DC State Tax refers to the tax obligations and regulations imposed by the District of Columbia on individuals, businesses, and entities operating or residing within its jurisdiction. With a unique political status as a federal district, the District of Columbia has its own tax system, distinct from the surrounding states of Maryland and Virginia. Understanding the intricacies of DC State Tax is crucial for both residents and businesses to ensure compliance and optimize their financial strategies.

Navigating DC State Tax: A Comprehensive Guide

In this comprehensive guide, we delve into the world of DC State Tax, exploring its key components, rates, and implications for taxpayers. By unraveling the complexities of this tax system, we aim to provide valuable insights and practical guidance to help you navigate your tax obligations effectively.

Tax Categories and Rates

The DC tax system encompasses various categories, each with its own set of rates and regulations. Here’s a breakdown of the primary tax categories in the District of Columbia:

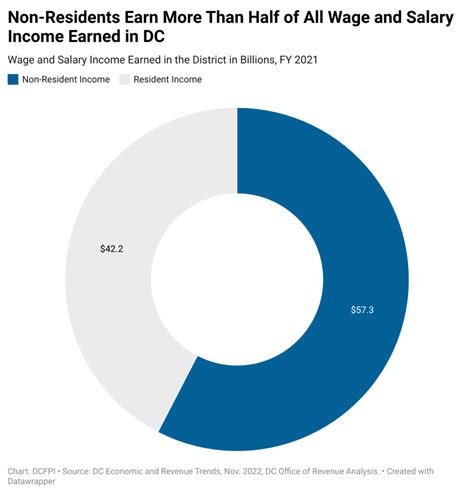

- Individual Income Tax: DC imposes an individual income tax on residents and non-residents earning income within the district. The tax rate ranges from 4% to 8.75%, depending on income brackets. Residents are required to file annual tax returns, while non-residents may need to file if they have DC-sourced income.

- Business and Corporate Taxes: Businesses operating in DC are subject to corporate income tax, sales and use tax, and various other business-related taxes. The corporate income tax rate is 8.75%, while sales tax rates vary based on the type of goods and services.

- Property Taxes: Property owners in DC are responsible for paying property taxes, which are calculated based on the assessed value of the property. The tax rate can vary by jurisdiction within the district.

- Estate and Inheritance Taxes: The District of Columbia levies taxes on estates and inheritances, with rates dependent on the value of the estate or the relationship between the deceased and the beneficiary.

- Excise Taxes: DC imposes excise taxes on specific goods and services, such as gasoline, tobacco products, and certain entertainment activities. These taxes are typically included in the price of the product or service.

| Tax Category | Rate Range |

|---|---|

| Individual Income Tax | 4% - 8.75% |

| Corporate Income Tax | 8.75% |

| Sales and Use Tax | Varies (5.75% - 11.75%) |

| Property Tax | Varies by jurisdiction |

| Estate and Inheritance Tax | Varies based on estate value and relationship |

| Excise Taxes | Varies by product or service |

Tax Filing and Compliance

Ensuring timely and accurate tax filing is essential to avoid penalties and maintain a positive relationship with the District of Columbia’s tax authorities. Here are some key considerations for tax filing and compliance:

- Individual taxpayers should obtain a DC Individual Tax Identification Number (ITIN) and file their tax returns annually by the designated deadline.

- Businesses must register with the District’s tax office and obtain the necessary permits and licenses. Regular reporting and payment of taxes are mandatory to avoid penalties.

- Taxpayers are encouraged to utilize the DC Office of Tax and Revenue’s online services for convenient tax filing, payment, and tracking.

- Maintaining proper records and documentation is vital for accurate tax reporting. This includes keeping track of income, expenses, purchases, and other tax-related transactions.

Tax Credits and Incentives

The District of Columbia offers various tax credits and incentives to support individuals and businesses. These initiatives aim to promote economic growth, encourage community development, and provide relief to specific taxpayer groups. Here are some notable tax credits and incentives available in DC:

- First-Time Homebuyer Credit: DC provides a tax credit to first-time homebuyers to assist with the costs of purchasing a primary residence within the district.

- Low-Income Housing Tax Credit: This credit aims to stimulate the development of affordable housing by offering tax incentives to investors and developers.

- Research and Development Tax Credit: Businesses engaged in research and development activities may be eligible for a tax credit to offset the costs associated with innovation and technological advancements.

- Work Opportunity Tax Credit: DC offers this credit to employers who hire individuals from targeted groups, such as veterans or individuals with disabilities.

- Historic Preservation Tax Credit: Property owners who undertake the rehabilitation of historic properties within the district may be eligible for tax credits.

Impact on Businesses and Residents

DC State Tax has a significant impact on both businesses and residents. For businesses, the tax system influences their financial planning, cost structure, and overall profitability. Understanding the tax landscape is crucial for making informed decisions regarding business operations, expansion, and tax optimization strategies.

For residents, DC State Tax affects their disposable income, savings, and overall financial well-being. Navigating the tax system effectively can help individuals maximize their after-tax income and plan for long-term financial goals.

Future Outlook and Trends

The District of Columbia’s tax landscape is subject to continuous evolution, influenced by economic factors, political decisions, and societal changes. Staying abreast of emerging trends and potential tax reforms is essential for taxpayers to adapt their strategies accordingly.

As the district strives to promote economic growth and address social issues, tax policies may undergo adjustments. Taxpayers should anticipate potential changes in tax rates, credits, and incentives, and stay informed about any proposed or enacted reforms.

Conclusion

Navigating DC State Tax requires a comprehensive understanding of the district’s unique tax system. By familiarizing yourself with the tax categories, rates, and compliance requirements, you can ensure accurate tax filing and optimize your financial strategies. Whether you’re an individual taxpayer or a business owner, staying informed and proactive is key to successfully navigating the complexities of DC State Tax.

What is the current DC income tax rate for individuals?

+The DC income tax rate for individuals ranges from 4% to 8.75%, depending on income brackets. Residents and non-residents earning income within the district are subject to this tax.

How often do businesses need to file tax returns in DC?

+Businesses in DC are typically required to file tax returns on a quarterly or annual basis, depending on their business structure and tax obligations. It’s important to consult with a tax professional or refer to the DC Office of Tax and Revenue’s guidelines for specific filing requirements.

Are there any tax incentives for renewable energy investments in DC?

+Yes, DC offers tax incentives for renewable energy investments. The Renewable Energy Property Tax Credit provides a credit for the installation of renewable energy systems, such as solar panels or wind turbines. This credit can help offset the costs of these environmentally friendly investments.

Can non-residents claim tax deductions for DC-sourced income?

+Non-residents may be eligible to claim tax deductions for DC-sourced income, but the specific deductions and requirements can vary. It’s advisable to consult with a tax professional or refer to the DC tax guidelines to understand the applicable deductions and their limitations.

How can I stay updated on DC tax reforms and changes?

+To stay informed about DC tax reforms and changes, you can regularly visit the official website of the DC Office of Tax and Revenue. They provide updates, news, and resources related to tax policies and regulations. Additionally, subscribing to tax-focused newsletters or following reputable tax information sources can help you stay abreast of any significant tax developments.