Cook County Tax Bill

Understanding your Cook County tax bill can be a complex task, especially for homeowners and property owners in the Chicago metropolitan area. With a diverse range of property types and varying assessment practices, the tax bill process in Cook County requires a comprehensive understanding. This article aims to provide an in-depth analysis of the Cook County tax bill, covering its components, calculation methods, and strategies for property owners to optimize their tax obligations. By breaking down the intricacies of the tax assessment and billing process, we aim to empower property owners with the knowledge to navigate this essential aspect of homeownership.

Unraveling the Cook County Tax Bill: A Comprehensive Guide

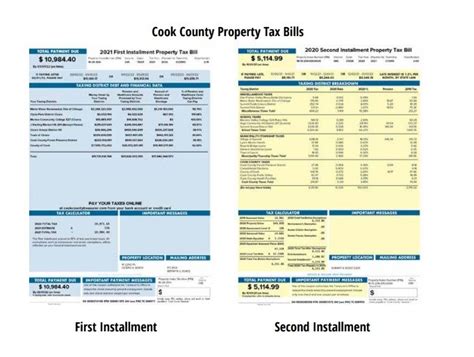

The Cook County tax bill is a crucial document for property owners, as it outlines the financial obligations they must fulfill to the county government. This bill is generated annually and is based on a complex assessment process that considers various factors, ensuring that property owners contribute their fair share to the local government's revenue.

Understanding the Assessment Process

The Cook County assessment process is a critical component in determining the tax bill. The county's Assessor's Office is responsible for evaluating properties and assigning values, which are then used as a basis for taxation. This process involves a thorough examination of properties, considering factors such as location, size, improvements, and recent sales data.

The assessment process is divided into two main categories: equalization and individual assessment. Equalization aims to ensure that all properties within the county are assessed at a similar rate, maintaining fairness across different areas. Individual assessment, on the other hand, focuses on the specific characteristics of each property, ensuring that unique features are accounted for in the valuation.

To ensure accuracy, the Assessor's Office employs a team of trained professionals who conduct thorough inspections and utilize advanced valuation techniques. This process is essential in determining the equalized assessed value (EAV), which forms the basis for taxation.

Calculating the Tax Bill

Once the EAV is determined, the tax bill calculation process begins. This involves a series of steps, each contributing to the final amount owed by property owners.

The first step is to apply the tax rate, which is determined by the county and other local taxing bodies. This rate is expressed as a percentage and is applied to the EAV to calculate the initial tax amount. For instance, if the tax rate is 5%, and a property has an EAV of $200,000, the initial tax amount would be $10,000.

However, the process doesn't stop there. The county then applies various tax exemptions and credits to reduce the tax burden for eligible property owners. These exemptions and credits can significantly impact the final tax bill, making them a crucial consideration for homeowners.

| Exemption Type | Description |

|---|---|

| Homestead Exemption | Reduces taxes for primary residences. |

| Senior Citizen Exemption | Offers tax relief to homeowners aged 65 and above. |

| Veteran's Exemption | Provides tax benefits to military veterans. |

After applying these exemptions, the county may also consider additional assessments or special taxes, which can further impact the tax bill. These assessments could be for specific improvements or services provided by the county, such as water and sewer charges.

Optimizing Your Tax Bill

For property owners in Cook County, understanding the assessment and billing process is just the first step. Taking proactive measures to optimize their tax obligations can lead to significant savings.

One effective strategy is to appeal the assessment. If a property owner believes their property has been overvalued, they can file an appeal with the Cook County Board of Review. This process involves providing evidence and justifications for a lower valuation, which could result in a reduced EAV and, subsequently, a lower tax bill.

Additionally, property owners should stay informed about available tax exemptions and credits. By understanding the eligibility criteria and applying for these benefits, homeowners can legally reduce their tax burden. For instance, the Homestead Exemption is a widely utilized benefit that provides a significant reduction in taxes for primary residences.

Future Implications and Trends

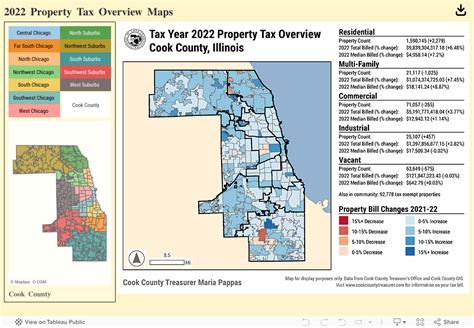

The Cook County tax landscape is constantly evolving, influenced by various economic, political, and social factors. Understanding these trends can provide valuable insights for property owners and investors.

One notable trend is the impact of real estate market fluctuations on tax assessments. As property values rise or fall, the Assessor's Office adjusts assessments accordingly. This means that property owners in areas experiencing rapid appreciation may see their tax bills increase, while those in declining markets might benefit from reduced assessments.

Furthermore, political decisions and budgetary constraints can significantly impact tax rates. In times of economic strain, local governments may increase tax rates to generate additional revenue, directly affecting property owners' tax obligations. Staying informed about local politics and budgetary decisions can help property owners anticipate and prepare for potential tax changes.

Conclusion: Empowering Property Owners

The Cook County tax bill is a complex yet crucial aspect of homeownership. By understanding the assessment process, calculation methods, and optimization strategies, property owners can take control of their tax obligations. From appealing assessments to leveraging tax exemptions, there are numerous ways to navigate the tax landscape effectively.

As the Chicago metropolitan area continues to evolve, staying informed about tax trends and changes is essential. By staying proactive and knowledgeable, property owners can ensure they are contributing fairly to the local community while also protecting their financial interests.

How often are properties reassessed in Cook County?

+Properties in Cook County are reassessed every three years. However, the Assessor’s Office may conduct reassessments more frequently in certain areas to ensure accuracy.

Can I appeal my tax bill if I disagree with the assessment?

+Yes, property owners have the right to appeal their tax assessment if they believe it is inaccurate or unfair. The process involves filing an appeal with the Cook County Board of Review and providing evidence to support your case.

Are there any tax breaks or incentives for specific property types in Cook County?

+Yes, Cook County offers various tax exemptions and incentives for different property types. For instance, there are special programs for historic properties, renewable energy installations, and affordable housing initiatives.

How can I stay updated on tax law changes and new exemptions?

+Staying informed is crucial. You can subscribe to newsletters from the Cook County Assessor’s Office, follow local news outlets, and attend community meetings or workshops to stay updated on tax-related changes and opportunities.