Collin County Tax Lookup

Welcome to the comprehensive guide on the Collin County Tax Lookup system. In this article, we will delve into the intricacies of the tax assessment and lookup process in Collin County, Texas. Understanding how the tax system works is essential for property owners, investors, and anyone interested in the real estate market in this thriving county. With its rapid growth and dynamic economic landscape, Collin County presents unique opportunities and challenges when it comes to property taxes.

Navigating the Collin County Tax System: A Comprehensive Guide

Collin County, known for its vibrant communities and thriving businesses, boasts a well-organized tax system that ensures fair and accurate assessments. The tax lookup process is designed to provide transparency and accessibility to property owners and stakeholders. In this section, we will explore the key components of the Collin County tax system and provide a step-by-step guide to navigating the tax lookup process.

Understanding Property Tax Assessments in Collin County

Property taxes are a vital source of revenue for local governments and play a significant role in funding essential services such as education, infrastructure, and public safety. In Collin County, the process of assessing property taxes involves several key steps:

- Property Valuation: The Collin County Appraisal District (CCAD) is responsible for determining the value of each property within the county. This valuation process takes into account various factors, including the property’s location, size, improvements, and market conditions.

- Tax Rate Determination: Once the property values are established, the local taxing authorities, including the county, cities, school districts, and special districts, set their respective tax rates. These tax rates are then applied to the assessed property values to calculate the final tax amount.

- Tax Calculation: The tax liability for each property is calculated by multiplying the assessed value by the applicable tax rate. The resulting amount is then divided by 1,000 to determine the tax rate per $100 of assessed value.

It's important to note that property taxes in Texas are ad valorem taxes, meaning they are based on the property's assessed value. This system ensures that property owners pay taxes proportional to the value of their property.

| Taxing Entity | 2023 Tax Rate (per $100) |

|---|---|

| Collin County | 0.4072 |

| City of Plano | 0.5930 |

| Plano ISD | 1.5368 |

| Special Districts (e.g., Water Districts) | Varies |

The Collin County Tax Lookup Process: Step-by-Step

- Access the Collin County Appraisal District (CCAD) Website: Begin by visiting the official website of the Collin County Appraisal District at https://www.ccad.org. This is the primary gateway to accessing tax-related information and services.

- Search for Your Property: On the homepage, you will find a search bar where you can enter your property’s address or Appraisal District Account Number (ADAN). This step allows you to locate your specific property record.

- View Property Details: Once you’ve located your property, you will be able to access a wealth of information. This includes the property’s assessed value, tax rates, and a detailed breakdown of the taxing entities associated with your property.

- Estimate Your Taxes: Using the provided tax rates and the assessed value, you can calculate your estimated property taxes. This estimation provides a clear understanding of your tax liability for the current year.

- Access Additional Resources: The CCAD website offers various resources to assist property owners. These include property tax exemptions, protest information, and details on how to appeal your property’s assessed value if you believe it is inaccurate.

Advanced Tax Lookup Features and Tools

The Collin County tax system offers several advanced features and tools to enhance the tax lookup experience and provide additional insights.

Online Tax Payment Portal

Collin County provides a convenient online tax payment portal, allowing property owners to pay their taxes securely and efficiently. This portal offers various payment methods and provides real-time transaction updates. By accessing your property record through the CCAD website, you can navigate to the payment portal and settle your tax obligations promptly.

Tax History and Trends Analysis

The tax lookup system in Collin County extends beyond the current year’s taxes. It provides access to historical tax data, enabling property owners and analysts to track tax trends over time. By examining past tax assessments and rates, stakeholders can gain valuable insights into the county’s tax landscape and make informed decisions regarding future investments.

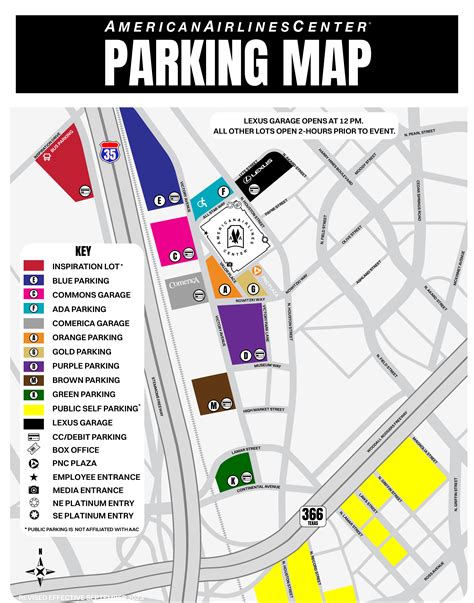

Interactive Tax Maps and Parcel Information

Collin County utilizes advanced GIS (Geographic Information System) technology to provide interactive tax maps and parcel information. These maps allow users to visualize property boundaries, zoning details, and other relevant data. This feature is particularly useful for real estate professionals, developers, and anyone interested in understanding the spatial context of property taxes in the county.

Future Implications and Developments

As Collin County continues to experience rapid growth and development, the tax system is poised for further advancements. The county’s commitment to transparency and accessibility is evident in its ongoing efforts to enhance the tax lookup process. Here are some potential future developments to watch for:

- Enhanced Data Visualization: The tax lookup system may integrate more advanced data visualization tools, allowing users to explore tax data interactively and gain deeper insights.

- Mobile Accessibility: With the increasing demand for mobile access, Collin County may introduce dedicated mobile applications for tax lookup and payment, ensuring convenience for on-the-go users.

- Integration with Other County Services: There is potential for the tax lookup system to integrate with other county services, such as permitting and licensing, streamlining processes for businesses and property owners.

- Real-Time Tax Alerts: Implementing a notification system that alerts property owners about changes in tax rates, assessments, or due dates could enhance user experience and ensure timely tax payments.

How often are property tax assessments conducted in Collin County?

+Property tax assessments are conducted annually in Collin County. The appraisal process typically begins in January and continues through April. The assessed values are then used to calculate property taxes for the upcoming year.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The Collin County Appraisal Review Board (ARB) handles protests and provides a process for property owners to present their case. It’s important to follow the timeline and procedures outlined by the ARB.

What are the tax exemptions available in Collin County, and how can I apply for them?

+Collin County offers various tax exemptions, including the Homestead Exemption, Over-65 Exemption, and Disability Exemption. To apply for these exemptions, you need to submit the appropriate forms and supporting documentation to the Collin County Appraisal District by the specified deadlines. The CCAD website provides detailed information on each exemption and the application process.