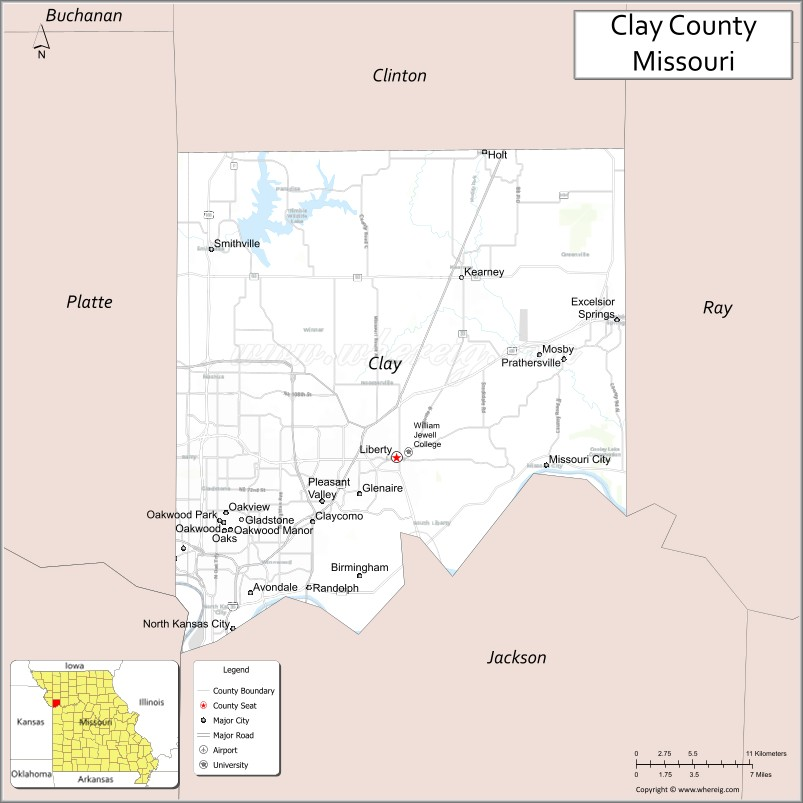

Clay County Personal Property Tax

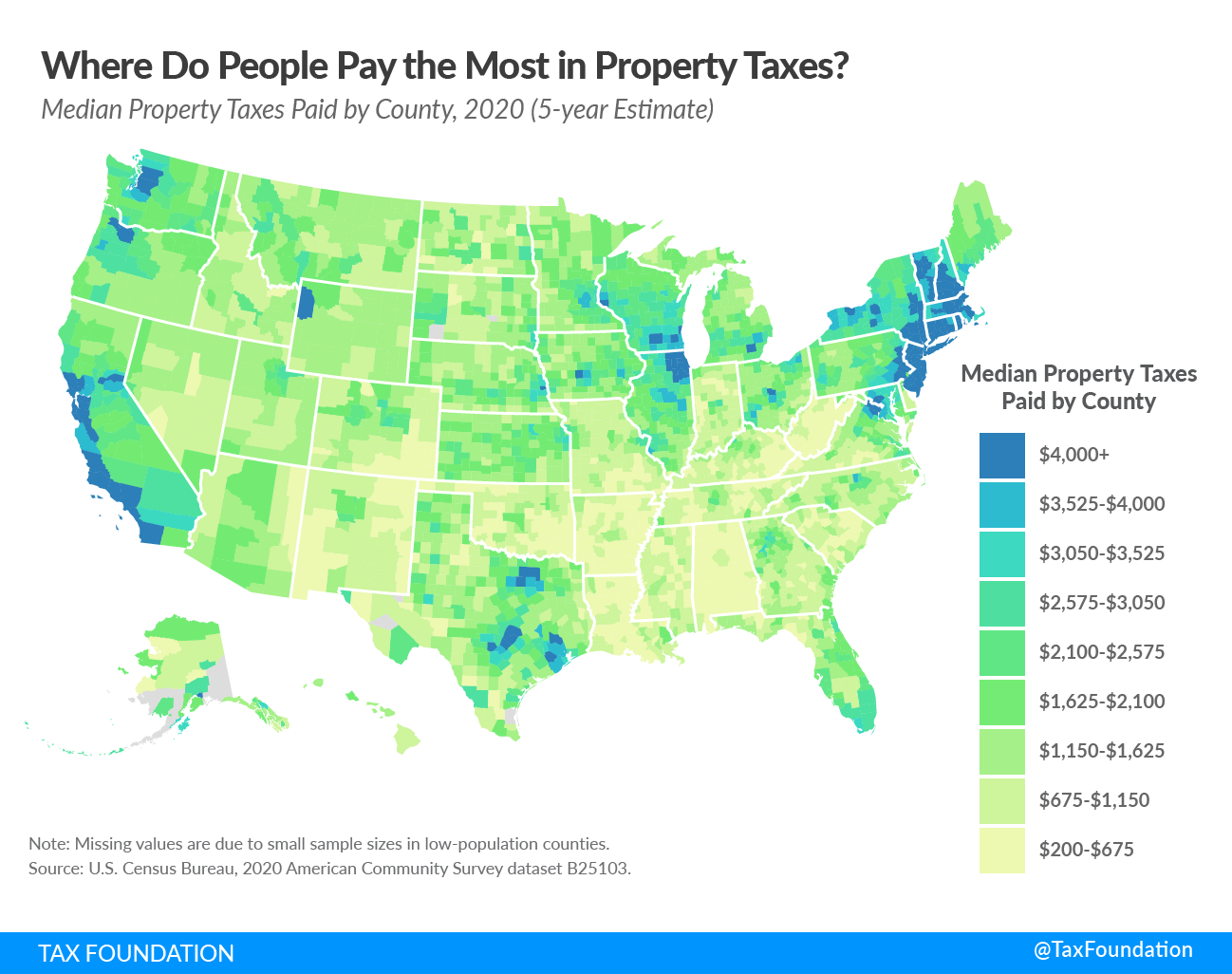

In Clay County, Missouri, property taxes are an essential aspect of local governance, playing a crucial role in funding public services and infrastructure. The personal property tax, a subset of property taxes, is a vital revenue stream for the county, and understanding its intricacies is key to comprehending the county's financial landscape.

The Significance of Clay County’s Personal Property Tax

The personal property tax in Clay County applies to a wide range of assets owned by individuals and businesses. These assets include vehicles, boats, airplanes, recreational vehicles, and business inventories. Unlike real estate property taxes, which are based on the assessed value of land and buildings, personal property taxes are levied on the value of tangible, movable assets.

This tax is a critical component of the county's budget, providing funds for essential services such as education, public safety, road maintenance, and social services. The revenue generated helps maintain the county's infrastructure, support local schools, and ensure the delivery of various community services.

According to the Clay County Assessor's Office, the personal property tax rate for the 2023 tax year is 2.85% for unincorporated areas of the county and 2.75% for incorporated areas. This rate is applied to the assessed value of personal property, which is determined by the Assessor's Office based on fair market value.

Assessment and Taxation Process

The assessment process begins with the Clay County Assessor determining the value of personal property. This valuation is based on a combination of factors, including the property’s age, condition, and market value. The Assessor’s Office uses various methods, such as physical inspections, sales data, and depreciation schedules, to ensure an accurate assessment.

Once the assessment is complete, property owners receive a notice of assessment, which outlines the value of their personal property and the calculated tax amount. This notice is typically sent out in the spring, providing property owners with an opportunity to review and appeal the assessment if they believe it is inaccurate.

The personal property tax is then due and payable, with the deadline typically falling in the summer months. Clay County offers various payment options, including online payment through the Clay County Treasurer's Office website, by mail, or in person at the Treasurer's Office.

Tax Relief and Exemptions

Clay County recognizes the potential financial burden of personal property taxes and offers various tax relief programs and exemptions to eligible residents and businesses.

Senior Citizen Tax Relief

Qualifying senior citizens in Clay County can apply for a reduction in their personal property taxes. To be eligible, individuals must be at least 65 years old, have a household income below a certain threshold, and have owned and occupied their property for a minimum of three years. The tax relief program provides a percentage reduction in the personal property tax bill, helping to ease the financial burden on senior citizens.

Disabled Veteran Exemption

Veterans with service-connected disabilities are entitled to a full exemption from personal property taxes in Clay County. This exemption applies to the primary residence and up to one acre of land. To claim this exemption, veterans must provide documentation from the U.S. Department of Veterans Affairs verifying their disability status.

Agricultural Property Tax Relief

Farmers and agricultural producers in Clay County can benefit from the Agricultural Property Tax Relief Program. This program offers a reduced tax rate for agricultural land, helping to support the county’s agricultural industry. To qualify, landowners must use their property primarily for agricultural purposes, and the land must be enrolled in the program through the Missouri Department of Agriculture.

Online Resources and Support

The Clay County Assessor’s Office and Treasurer’s Office provide extensive online resources to assist property owners in understanding the personal property tax process. These resources include tax rate information, assessment guidelines, payment instructions, and details on tax relief programs and exemptions.

The Clay County Assessor's Office website offers an online valuation estimator tool, allowing property owners to estimate the value of their personal property based on similar properties in the county. This tool provides a valuable resource for property owners to understand their potential tax liability.

Contact Information

For further assistance or inquiries, property owners can reach out to the Clay County Assessor’s Office and Treasurer’s Office via phone, email, or in person. The offices are dedicated to providing clear and accurate information to ensure a transparent and fair personal property tax system.

| Office | Contact Information |

|---|---|

| Clay County Assessor's Office | Phone: (816) 407-3700 Email: assessor@claycountymo.gov |

| Clay County Treasurer's Office | Phone: (816) 407-3900 Email: treasurer@claycountymo.gov |

Community Impact and Future Considerations

The personal property tax in Clay County not only contributes to the county’s financial stability but also has a significant impact on the local community. The revenue generated supports local schools, ensuring a quality education for students. It also funds public safety initiatives, maintaining a safe and secure environment for residents.

Looking ahead, the county's leadership must continue to balance the need for sufficient revenue with the financial well-being of its residents. This delicate balance involves regularly reviewing and adjusting tax rates, ensuring they remain fair and competitive, and exploring new initiatives to enhance the county's financial stability without placing an undue burden on taxpayers.

Additionally, as the county continues to grow and develop, it must consider the evolving needs of its residents and businesses. This includes staying informed about changing economic conditions, assessing the impact of new developments on the tax base, and implementing strategies to attract and retain businesses, thereby diversifying the county's tax revenue sources.

In conclusion, the personal property tax in Clay County is a vital component of the county's financial framework, providing the necessary funds to support essential services and infrastructure. By understanding the assessment and taxation process, exploring tax relief options, and staying informed about online resources, property owners can navigate this process with confidence, contributing to the county's vibrant and thriving community.

How is the personal property tax rate determined in Clay County?

+The personal property tax rate in Clay County is set by the county’s governing body. For the 2023 tax year, the rate is 2.85% for unincorporated areas and 2.75% for incorporated areas. These rates are applied to the assessed value of personal property.

When is the personal property tax due in Clay County?

+The personal property tax in Clay County is typically due in the summer months. The exact due date may vary each year, so it’s essential to check the Clay County Treasurer’s Office website for the most up-to-date information.

What are the payment options for personal property taxes in Clay County?

+Clay County offers various payment options for personal property taxes. These include online payment through the Clay County Treasurer’s Office website, payment by mail, and in-person payment at the Treasurer’s Office. Property owners can choose the most convenient option for them.

How can I appeal my personal property tax assessment in Clay County?

+If you believe your personal property tax assessment is inaccurate, you can appeal the decision. The Clay County Assessor’s Office provides information on the appeal process, including deadlines and necessary documentation. It’s important to follow the prescribed steps to ensure a successful appeal.

Are there any tax relief programs available for personal property taxes in Clay County?

+Yes, Clay County offers several tax relief programs and exemptions to eligible residents and businesses. These include senior citizen tax relief, disabled veteran exemption, and agricultural property tax relief. Property owners should explore these options to see if they qualify for any tax relief.