City Of San Diego Property Tax

The city of San Diego, nestled along the pristine coast of Southern California, boasts a vibrant real estate market and a thriving community. Among the many aspects that influence the local economy and residents' lives, property taxes play a significant role. Understanding the intricacies of San Diego's property tax landscape is essential for homeowners, prospective buyers, and investors alike. In this comprehensive guide, we will delve into the specifics of the City of San Diego property tax system, shedding light on its calculations, assessment processes, and the various factors that contribute to this vital component of local governance.

The Fundamentals of San Diego Property Taxes

Property taxes in San Diego, as in many other regions, serve as a primary source of revenue for the local government, funding essential services such as education, public safety, infrastructure development, and maintenance. The amount of property tax owed by individual property owners is determined by a combination of factors, including the assessed value of the property and the tax rate applied by the local jurisdiction.

The assessed value of a property is a crucial component in property tax calculations. In San Diego, the process of property assessment is carried out by the San Diego County Assessor's Office. This office is responsible for determining the full cash value or fair market value of each property within the county, which forms the basis for the assessment.

The full cash value is the amount that the property would fetch if it were sold on the open market, while the fair market value considers the property's worth based on its location, size, features, and recent sales of similar properties in the area. These values are then used to calculate the property's assessed value, which is the basis for the tax assessment.

Assessment Process and Tax Rates

The assessment process in San Diego is governed by state laws and regulations. The San Diego County Assessor’s Office conducts regular property assessments to ensure that the assessed values remain up-to-date and accurate. This process typically involves physical inspections, data analysis, and consideration of market trends.

Once the assessed value of a property is determined, it is multiplied by the applicable tax rate to calculate the property tax owed. The tax rate, also known as the tax levy, is set by the local government and can vary depending on the jurisdiction. In San Diego, the tax rate is often expressed as a percentage and includes components from various taxing authorities, such as the city, county, and special districts.

For instance, the City of San Diego may have a specific tax rate, while the San Diego Unified School District might have a separate tax rate that contributes to funding local education. These rates are combined to form the overall tax rate applicable to a particular property.

| Jurisdiction | Tax Rate (%) |

|---|---|

| City of San Diego | 1.05 |

| San Diego Unified School District | 1.25 |

| Other Special Districts | Varies |

It's important to note that the tax rates can change annually, and property owners should refer to official sources or consult with tax professionals to obtain the most accurate and up-to-date information.

Factors Influencing Property Tax Assessments

Assessed Value Calculations

The assessed value of a property is not a static figure but rather a dynamic measure that can change over time. Several factors contribute to the determination of a property’s assessed value, including:

- Market Conditions: The real estate market plays a significant role in property value assessments. Factors such as supply and demand, economic trends, and local development projects can influence the assessed value of properties.

- Property Improvements: Any improvements or upgrades made to a property, such as renovations, additions, or upgrades to systems, can impact its assessed value. These improvements are typically considered when determining the property's current worth.

- Comparable Sales: The San Diego County Assessor's Office often considers recent sales of similar properties in the area to ensure that the assessed value is in line with the fair market value. This comparative analysis helps maintain consistency and fairness in the assessment process.

Proposition 13 and Property Tax Caps

California’s Proposition 13, passed in 1978, introduced significant changes to the state’s property tax system. One of its key provisions is the limitation on annual property tax increases. Under Proposition 13, the assessed value of a property can only increase by a maximum of 2% per year, unless the property undergoes a change in ownership or new construction.

This cap helps protect homeowners from sudden and drastic increases in their property taxes. However, it also means that the assessed value of a property may not accurately reflect its current market value, especially in a rapidly appreciating real estate market like San Diego.

Change in Ownership and New Construction

When a property changes ownership or undergoes new construction, the assessed value may be reassessed to reflect the property’s current market value. This reassessment can result in a higher property tax bill for the new owner or for the owner following the construction project.

For instance, if a homeowner in San Diego purchases a property at a significantly higher price than the previous assessed value, the new assessed value will be based on the purchase price, potentially leading to a higher property tax obligation.

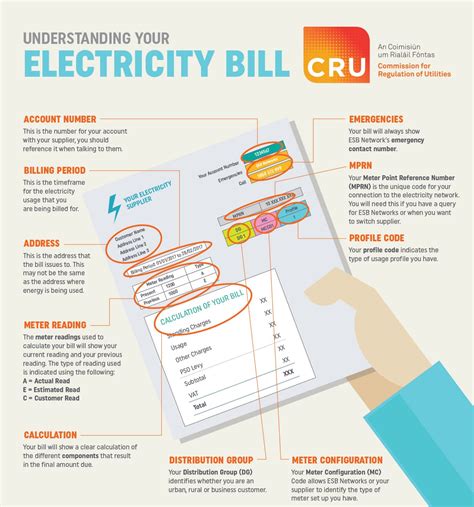

Property Tax Bills and Payment Options

Property owners in San Diego receive their property tax bills, also known as secured property tax bills, from the San Diego County Treasurer-Tax Collector’s Office. These bills are typically mailed to property owners in the fall, and the due date is usually in the winter months.

Property owners have several options for paying their property taxes, including online payments, by mail, or in person at designated payment locations. It's crucial to ensure timely payment to avoid penalties and interest charges.

Appealing Property Tax Assessments

If a property owner believes that their property’s assessed value is inaccurate or unfair, they have the right to appeal the assessment. The appeal process in San Diego is managed by the San Diego County Assessment Appeals Board. Property owners can file an appeal within a specified timeframe, typically after receiving their property tax bill.

During the appeal process, the property owner presents their case, often with supporting evidence, to demonstrate why the assessed value should be adjusted. The Assessment Appeals Board reviews the appeal and makes a decision, which can result in a reduction of the assessed value and, consequently, a lower property tax bill.

The Impact of Property Taxes on San Diego’s Economy

Property taxes play a crucial role in San Diego’s economy, funding vital public services and infrastructure projects. The revenue generated from property taxes contributes to the city’s overall financial health and stability.

Moreover, property taxes also influence the local real estate market. Prospective buyers and investors consider property taxes when evaluating the affordability and financial viability of a property. A well-managed and transparent property tax system can attract investment and promote economic growth in the region.

Conclusion: Navigating San Diego’s Property Tax Landscape

Understanding the intricacies of San Diego’s property tax system is essential for anyone with an interest in the local real estate market. From the assessment process to tax rates and appeal procedures, each component plays a crucial role in determining the property tax obligations of San Diego residents.

By staying informed and actively engaging with the local government and assessment authorities, property owners can ensure that their property taxes are fair and accurate. Additionally, for prospective buyers and investors, a thorough understanding of San Diego's property tax landscape can provide valuable insights into the financial aspects of real estate transactions.

As the city continues to thrive and evolve, its property tax system remains a critical component of its economic foundation. With its vibrant community and stunning natural surroundings, San Diego offers a unique and desirable living environment, and a comprehensive understanding of property taxes is a key part of navigating this beautiful city's real estate landscape.

How often are property values reassessed in San Diego?

+Property values in San Diego are generally reassessed every two years, although certain changes, such as ownership transfers or new construction, can trigger a reassessment at any time.

Can I pay my property taxes online in San Diego?

+Yes, property owners in San Diego have the option to pay their property taxes online through the San Diego County Treasurer-Tax Collector’s website. It’s a convenient and secure method of payment.

What happens if I don’t pay my property taxes on time in San Diego?

+Late payment of property taxes in San Diego can result in penalties and interest charges. It’s important to pay your property taxes by the due date to avoid additional financial burdens.

How can I estimate my property taxes in San Diego before purchasing a home?

+You can estimate your property taxes by multiplying the assessed value of the property by the applicable tax rate. However, it’s advisable to consult with a real estate professional or tax advisor for a more accurate estimate.

Are there any exemptions or discounts available for property taxes in San Diego?

+Yes, San Diego offers various exemptions and discounts for property taxes, including homeowner’s exemptions, senior citizen exemptions, and disabled veteran exemptions. It’s worth exploring these options to potentially reduce your property tax obligations.