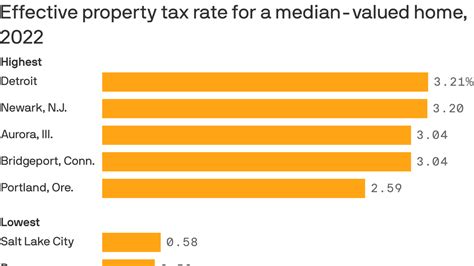

City Of Detroit Property Taxes

The city of Detroit, Michigan, has a unique and complex system for property taxation, which has undergone significant changes in recent years. Understanding the intricacies of Detroit's property taxes is crucial for homeowners, investors, and anyone interested in the real estate market within the city. This comprehensive guide will delve into the specifics of Detroit's property tax landscape, providing an in-depth analysis of how it works and its implications.

Understanding Detroit’s Property Tax Structure

Detroit’s property tax system is governed by a combination of local, state, and federal regulations. The city’s unique history and its status as a major urban center in the United States have influenced the development of its property tax policies. Here’s a breakdown of the key components:

Taxable Value and State Equalized Value (SEV)

In Detroit, the taxable value of a property is a critical concept. It represents the assessed value of the property for tax purposes and is often lower than the market value. The taxable value is based on the property’s State Equalized Value (SEV), which is determined annually by the city’s assessor.

The SEV takes into account various factors, including:

- Recent sales of similar properties in the area.

- Building improvements and renovations.

- Economic conditions and market trends.

Tax Rates and Assessments

Detroit’s property tax rates are set by the city, county, and local school districts. These rates are applied to the taxable value of the property to calculate the annual property tax bill. The tax rates can vary significantly depending on the location within the city and the services provided by the specific taxing authority.

The assessment process involves evaluating the property’s characteristics, such as size, location, and any recent improvements. This assessment determines the property’s taxable value, which is then multiplied by the applicable tax rate to arrive at the tax liability.

Homestead and Non-Homestead Properties

Detroit distinguishes between homestead and non-homestead properties, which can impact the tax assessment and potential tax incentives. Homestead properties are those occupied as the primary residence by the owner, while non-homestead properties include rental units, commercial spaces, and vacant land.

Homestead properties often have certain advantages, such as the Homestead Exemption, which can reduce the taxable value of the property. This exemption is particularly beneficial for long-term residents and can significantly lower property tax bills.

| Property Type | Taxable Value | Potential Advantages |

|---|---|---|

| Homestead | Lower taxable value due to exemptions | Reduced tax burden, especially for long-term residents |

| Non-Homestead | Typically assessed at full market value | None, but may offer opportunities for investment |

Special Assessments and Millage Rates

In addition to the standard property taxes, Detroit may levy special assessments for specific services or improvements. These assessments are often used to fund projects like infrastructure upgrades, security initiatives, or community development programs. The millage rate, which is the tax rate expressed in mills (one-tenth of a cent), determines the amount owed for these assessments.

Property Tax Calculation and Payment

The process of calculating and paying property taxes in Detroit involves several key steps. Homeowners and property owners should be aware of these procedures to ensure timely and accurate payments.

Assessment Notices and Tax Bills

Property owners in Detroit receive assessment notices from the city’s assessor, typically once a year. These notices detail the property’s SEV, taxable value, and any changes from the previous year. It is crucial to review these notices carefully, as they form the basis for the upcoming tax bill.

The tax bill, also known as the tax statement, is sent out separately and includes the calculated tax amount, due dates, and payment options. It is essential to keep track of these bills to avoid late fees and penalties.

Payment Options and Due Dates

Detroit offers various payment options for property taxes, including online payment portals, mail-in checks, and in-person payments at designated locations. The due dates are usually spread out over the year, with two or more installments. Missing a payment deadline can result in penalties and interest charges.

For instance, the city might have a payment schedule where the first installment is due in February, with a second installment due in July. Late payments could incur a penalty of 1% per month on the unpaid amount.

Payment Plans and Appeals

In cases where property owners face financial difficulties, Detroit provides options for payment plans to help manage tax obligations. These plans allow for the payment of taxes over an extended period, with reduced penalties and interest. However, there may be eligibility criteria and application processes involved.

If a property owner believes that their tax assessment is incorrect or unfair, they have the right to appeal the assessment. The appeal process involves submitting evidence and justifications to support a re-evaluation of the property’s taxable value. Successful appeals can lead to reduced tax bills.

Impact on Real Estate Market and Community

Detroit’s property tax system has a profound impact on the local real estate market and community dynamics. Understanding these effects is essential for both investors and residents.

Influence on Property Values and Sales

Property taxes can significantly affect the desirability and affordability of real estate in Detroit. Higher taxes may discourage potential buyers, especially in areas where tax rates are above the city’s average. On the other hand, lower tax rates can attract investors and homeowners, stimulating the local market.

For instance, a comparison of tax rates between Detroit’s neighborhoods can reveal significant differences. Neighborhood A, with a lower tax rate, might experience a higher demand for real estate, leading to increased property values over time.

Community Development and Revitalization

Property taxes play a crucial role in funding community development initiatives. The revenue generated from these taxes is often invested back into the community, supporting projects such as:

- Improving public infrastructure like roads, parks, and utilities.

- Enhancing public safety measures.

- Developing educational facilities and programs.

- Providing social services and community resources.

These investments can contribute to the overall well-being and growth of Detroit’s neighborhoods, making them more attractive places to live and work.

Impact on Local Businesses and Economy

The property tax system also influences the business landscape in Detroit. Commercial property owners face unique challenges and opportunities. Higher tax rates can impact a business’s profitability, especially for small businesses with limited financial resources.

On the positive side, Detroit’s tax incentives and programs aimed at supporting local businesses can offset some of these challenges. These initiatives may include tax abatements, special assessment districts, and other forms of financial assistance.

Future Outlook and Potential Changes

As Detroit continues its economic revival and urban renewal, the city’s property tax system is likely to evolve. Here are some potential future developments and their implications.

Potential Tax Reform and Initiatives

There have been ongoing discussions and proposals for tax reform in Detroit, aiming to create a more equitable and efficient system. These reforms could include:

- Revising tax rates and assessments to better reflect market values.

- Introducing new tax incentives to attract businesses and residents.

- Streamlining the tax collection process to reduce administrative costs.

- Implementing measures to prevent tax delinquency and ensure timely payments.

Impact of Urban Development and Population Growth

Detroit’s ongoing urban development and population growth have the potential to significantly impact the property tax landscape. As the city attracts new residents and businesses, the demand for real estate may increase, leading to higher property values and, consequently, higher tax revenues.

However, managing this growth sustainably is crucial to ensure that the city’s infrastructure and services can accommodate the increased population without straining the existing tax system.

Environmental and Social Considerations

Detroit’s future property tax policies may also incorporate environmental and social considerations. This could involve:

- Incentivizing green initiatives and sustainable development through tax breaks.

- Implementing programs to support affordable housing and reduce tax burdens on low-income residents.

- Investing in community-based projects that promote social equity and inclusion.

What is the average property tax rate in Detroit?

+The average property tax rate in Detroit varies by neighborhood and can range from 1.5% to 3% of the property’s taxable value. However, specific rates may differ based on the location and the services provided by the taxing authority.

Are there any tax incentives or exemptions available in Detroit?

+Yes, Detroit offers several tax incentives and exemptions. These include the Homestead Exemption for primary residences, tax abatements for certain commercial properties, and special assessment districts aimed at supporting local businesses.

How can I appeal my property tax assessment in Detroit?

+To appeal your property tax assessment in Detroit, you must first submit a written request for review to the city’s assessor. The request should include evidence and justifications supporting your claim. If the review does not result in a satisfactory outcome, you can file a formal appeal with the Michigan Tax Tribunal.

What happens if I miss a property tax payment deadline in Detroit?

+Missing a property tax payment deadline in Detroit can result in late fees and interest charges. If the delinquency persists, the city may place a tax lien on the property, which could lead to foreclosure if not resolved.

How does Detroit’s property tax system impact the local real estate market?

+Detroit’s property tax system can influence the real estate market by affecting the demand for properties. Higher tax rates may discourage buyers, especially in areas with above-average rates. Conversely, lower tax rates can attract investors and homeowners, stimulating the market.