Check Dc Tax Refund Status

When it comes to tax refunds, staying informed and up-to-date is crucial for taxpayers. Understanding the process and having access to real-time information can help alleviate concerns and provide clarity on the status of your refund. In this comprehensive guide, we will delve into the steps and resources available to check your DC tax refund status, ensuring you have the knowledge and tools to navigate this process efficiently.

Understanding the DC Tax Refund Process

The District of Columbia, like many other jurisdictions, processes tax refunds for residents and businesses. The process begins with the timely filing of tax returns, which triggers the evaluation and assessment of the refund amount. Once the assessment is complete, the refund is issued, and taxpayers eagerly await its arrival. However, the timeline and specific steps involved can vary, making it essential to have accurate information at your disposal.

Online Tools for Real-Time Updates

The DC Office of Tax and Revenue (OTR) offers a user-friendly online platform designed to provide taxpayers with convenient access to their tax information. By leveraging this platform, you can quickly and easily check the status of your DC tax refund, eliminating the need for guesswork and speculation.

Step-by-Step Guide to Checking Your DC Tax Refund Status

To assist you in navigating this process seamlessly, we have outlined a comprehensive step-by-step guide. By following these instructions, you will be able to access your refund status efficiently and with confidence.

-

Access the DC OTR Website

Begin by visiting the official website of the DC Office of Tax and Revenue (OTR). This is the primary source of information and tools related to DC tax matters.

-

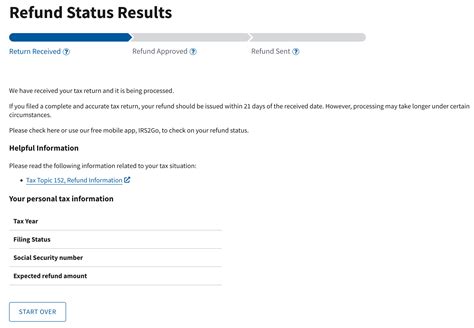

Navigate to the Tax Refund Status Page

Once on the OTR website, locate and click on the "Tax Refund Status" link or tab. This page is specifically dedicated to providing taxpayers with real-time updates on their refund status.

-

Enter Your Taxpayer Information

On the Tax Refund Status page, you will be prompted to enter specific details to access your personal tax information. Typically, this includes your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and other identifying information.

-

Submit Your Request

After entering your taxpayer information, click the "Submit" or "Search" button to initiate the refund status check. The system will process your request and retrieve the latest information on your refund.

-

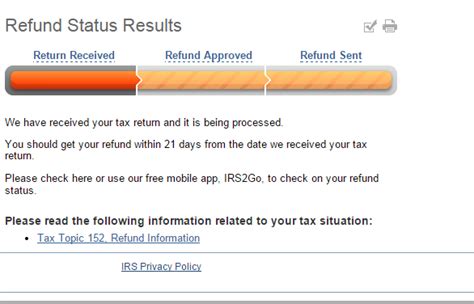

Review Your Refund Status

Upon successful submission, you will be presented with a detailed overview of your DC tax refund status. This information may include the current processing stage, the estimated refund amount, and any additional relevant details.

-

Monitor Regularly for Updates

It is advisable to regularly check your refund status, especially if you have recently filed your tax return or are expecting a refund. By doing so, you can stay informed about any changes or updates to your refund status.

💡 Pro Tip: Consider bookmarking the DC OTR website for easy access to your tax-related information and tools. This ensures you can quickly revisit the site to check on your refund status or explore other tax-related services.

Exploring Additional Resources for Tax Refund Information

While the DC OTR website is the primary source of tax refund status updates, there are other resources available to taxpayers seeking further information and assistance.

DC OTR Contact Information

In addition to the online platform, the DC OTR provides various contact methods for taxpayers to reach out and obtain assistance. These include telephone hotlines, email addresses, and physical office locations. By contacting the OTR directly, you can receive personalized support and guidance related to your tax refund status and other tax-related queries.

| Contact Method | Details |

|---|---|

| Telephone | Main Number: (202) 727-4TAX (4829) |

| Toll-Free Number: (866) 449-0445 | |

| General Inquiries: tax.help@dc.gov | |

| Physical Office | DC Office of Tax and Revenue |

| 441 4th Street, NW, Suite 560 | |

| Washington, DC 20001 |

Taxpayer Assistance Programs

For taxpayers seeking additional support and guidance, the DC OTR offers Taxpayer Assistance Programs. These programs provide specialized assistance to individuals facing unique tax-related challenges, such as those with limited English proficiency or individuals with disabilities.

Online Taxpayer Resources

The DC OTR website also features a wealth of resources and information tailored to taxpayers. These resources cover a wide range of topics, including tax forms, publications, and frequently asked questions (FAQs). By exploring these resources, you can gain a deeper understanding of the tax system and stay informed about any changes or updates that may impact your refund status.

Understanding the DC Tax Refund Timeline

While the DC OTR strives to process tax refunds as quickly as possible, the timeline can vary depending on various factors. Understanding the typical refund timeline can help manage expectations and provide a realistic estimate of when to expect your refund.

Typical DC Tax Refund Timeline

On average, the DC OTR aims to process tax refunds within 4 to 6 weeks from the date of filing. However, it is important to note that this timeline is subject to change and may be influenced by factors such as the complexity of the tax return, the accuracy of the information provided, and the volume of tax returns being processed.

Factors Affecting Refund Processing Time

Several factors can impact the processing time of your DC tax refund. These include:

- Filing Errors: Inaccurate or incomplete information on your tax return can lead to delays in processing. It is crucial to review your return carefully before submission to avoid potential errors.

- Audit Considerations: In some cases, the DC OTR may select certain tax returns for audit. If your return is chosen for audit, it may take additional time to resolve any discrepancies and process your refund.

- Peak Tax Seasons: The DC OTR experiences higher volumes of tax returns during peak tax seasons, such as the traditional filing deadline in April. During these periods, processing times may be slightly longer due to the increased workload.

Addressing Common DC Tax Refund Issues

Despite the best efforts of the DC OTR, taxpayers may encounter various issues or concerns related to their tax refund. Being aware of these potential issues and knowing how to address them can help alleviate any worries and ensure a smoother refund process.

Refund Delays

In some cases, taxpayers may experience delays in receiving their DC tax refund. If you have not received your refund within the expected timeframe, it is recommended to take the following steps:

- Check your refund status regularly using the online platform provided by the DC OTR.

- Review your tax return for any potential errors or discrepancies that may have caused a delay.

- Contact the DC OTR directly using the contact information provided earlier in this guide. Their team can provide further guidance and assistance in resolving any issues related to refund delays.

Refund Errors

Occasionally, taxpayers may encounter errors in their DC tax refund, such as receiving an incorrect amount or experiencing discrepancies between the expected and actual refund. If you suspect an error with your refund, it is important to take immediate action:

- Review your tax return and compare it with the refund amount received.

- Contact the DC OTR to report the error and provide them with the necessary details to investigate and resolve the issue.

- Keep records of all communications and documents related to your refund to facilitate the resolution process.

Identity Theft and Fraud

Unfortunately, tax refund fraud and identity theft are prevalent issues that taxpayers must be vigilant against. If you suspect that your tax refund has been affected by fraud or identity theft, it is crucial to take prompt action to protect your rights and finances:

- Contact the DC OTR immediately to report the potential fraud or identity theft.

- File a report with the local law enforcement authorities to document the incident and initiate an investigation.

- Monitor your tax records and credit reports regularly to detect any unauthorized activities or changes.

- Consider placing a fraud alert or freeze on your credit reports to prevent further misuse of your personal information.

💡 Expert Tip: Stay informed about the latest tax-related scams and fraud schemes by subscribing to newsletters or alerts provided by the DC OTR or other reputable sources. Being aware of potential threats can help you identify and report suspicious activities promptly.

Conclusion: Empowering Taxpayers with Knowledge

By providing taxpayers with the knowledge and resources to check their DC tax refund status, we aim to empower individuals to take control of their tax-related matters. Understanding the process, utilizing the available tools, and staying informed about potential issues are essential steps toward a smooth and efficient refund experience.

Remember, the DC Office of Tax and Revenue is dedicated to serving taxpayers and ensuring a fair and transparent tax system. By leveraging the resources and guidance provided, you can navigate the DC tax refund process with confidence and ease.

Frequently Asked Questions

How long does it typically take to receive my DC tax refund after filing my return?

+On average, it takes approximately 4 to 6 weeks from the date of filing for the DC Office of Tax and Revenue (OTR) to process tax refunds. However, this timeline can vary based on factors such as filing errors, audits, and peak tax seasons.

What should I do if I haven’t received my DC tax refund within the expected timeframe?

+If you haven’t received your DC tax refund within the expected timeframe, it is recommended to take the following steps: regularly check your refund status using the online platform provided by the DC OTR, review your tax return for any errors or discrepancies, and contact the DC OTR directly for further assistance.

How can I contact the DC Office of Tax and Revenue (OTR) for tax refund-related inquiries?

+You can contact the DC OTR through various methods: by calling the main number at (202) 727-4TAX (4829) or the toll-free number at (866) 449-0445, sending an email to tax.help@dc.gov for general inquiries, or visiting their physical office located at 441 4th Street, NW, Suite 560, Washington, DC 20001.

Are there any online resources available to taxpayers seeking information about their DC tax refund status or other tax-related matters?

+Yes, the DC OTR website offers a range of online resources, including tax forms, publications, and frequently asked questions (FAQs). These resources provide valuable information and guidance to taxpayers seeking assistance with their tax refund status or other tax-related queries.

What should I do if I suspect an error or fraud related to my DC tax refund?

+If you suspect an error or fraud related to your DC tax refund, it is crucial to take immediate action. Review your tax return and compare it with the refund amount received, contact the DC OTR to report the issue, keep records of all communications and documents, and consider placing a fraud alert or freeze on your credit reports to protect your personal information.