California Sales And Use Tax

The world of taxation can be complex and intricate, with varying rules and regulations across different regions. One such intricate tax system is the California Sales and Use Tax, a critical component of the state's revenue stream. This tax system plays a pivotal role in California's economy, influencing the cost of goods and services for both residents and businesses. In this comprehensive guide, we will delve into the intricacies of California Sales and Use Tax, exploring its history, current status, and its impact on the state's economy and businesses.

A Historical Perspective: Evolution of California Sales and Use Tax

The roots of California’s Sales and Use Tax can be traced back to the early 20th century, with the first Sales Tax law enacted in 1933. This initial legislation was a response to the Great Depression, aiming to generate additional revenue for the state. Over the years, the tax system has undergone significant transformations, adapting to the changing economic landscape and the evolving needs of the state.

One of the key milestones in the history of California Sales Tax was the introduction of the Use Tax in 1935. This tax was designed to complement the Sales Tax, targeting goods purchased from out-of-state vendors and used within California. The dual Sales and Use Tax structure ensured that all goods, regardless of their origin, contributed to the state's revenue.

Throughout the decades, the California Sales and Use Tax has been subject to numerous amendments and revisions. These changes have been driven by a range of factors, including economic trends, technological advancements, and the state's evolving fiscal needs. For instance, the rise of e-commerce in the late 20th and early 21st centuries presented unique challenges and opportunities for the tax system, leading to a series of legislative updates to ensure equitable taxation in the digital age.

Understanding the Basics: What is California Sales and Use Tax?

California Sales and Use Tax is a consumption tax levied on the sale or use of tangible personal property and certain services within the state. It is a vital source of revenue for California, contributing significantly to the state’s general fund and various special funds dedicated to specific purposes.

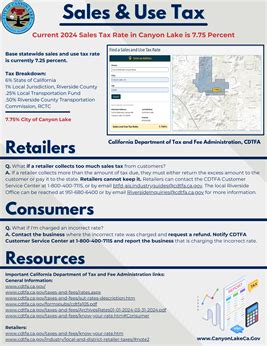

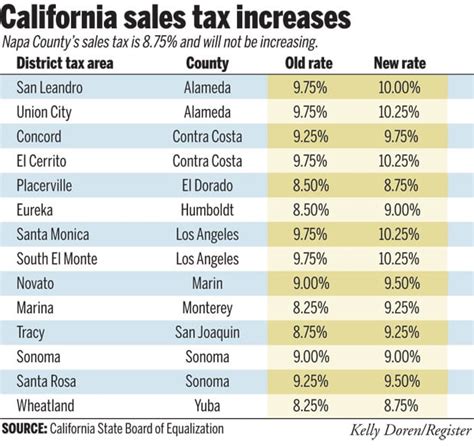

The Sales Tax is applied to the retail sale of most goods, including tangible personal property, certain digitally delivered products, and certain services. The tax rate varies across different jurisdictions within the state, with the state-level rate set at 7.25% as of 2023. However, when combined with local and district taxes, the total Sales Tax rate can be significantly higher, often reaching upwards of 10% in certain areas.

On the other hand, the Use Tax is a complementary tax to the Sales Tax. It is applied to the storage, use, or consumption of tangible personal property in California when the Sales Tax was not collected at the point of sale. This tax ensures that all goods used or consumed within the state contribute to the state's revenue, regardless of where they were purchased.

Key Differences Between Sales Tax and Use Tax

While both Sales Tax and Use Tax are consumption taxes, there are some key differences between the two:

- Point of Taxation: Sales Tax is collected at the point of sale, while Use Tax is applied when goods are stored, used, or consumed in California without the Sales Tax being paid.

- Target Audience: Sales Tax is typically levied on retailers, who collect the tax from consumers at the time of purchase. Use Tax, on the other hand, is often self-assessed by consumers or businesses when they purchase goods from out-of-state vendors without paying Sales Tax.

- Compliance: Compliance with Sales Tax is generally enforced through the registration and remittance process for retailers. Use Tax compliance, however, relies more on self-reporting and can be more challenging to enforce.

The Impact on California’s Economy and Businesses

California Sales and Use Tax has a profound impact on the state’s economy and the businesses operating within its borders. The tax system is a significant source of revenue for the state, funding a wide range of public services and infrastructure projects. It also influences the cost of doing business and the overall cost of living for residents.

Revenue Generation and Allocation

California Sales and Use Tax generates billions of dollars in revenue annually, making it a critical component of the state’s fiscal health. This revenue is allocated to various areas, including education, healthcare, transportation, and public safety. The tax system also supports specific programs and initiatives, such as environmental conservation and affordable housing projects.

| Revenue Allocation (2021) | Percentage |

|---|---|

| Education | 36% |

| Health and Human Services | 25% |

| Transportation | 18% |

| Public Safety | 8% |

| Other (including debt service) | 13% |

Cost of Doing Business

For businesses, the Sales and Use Tax is a significant consideration in their financial planning and operational strategies. The tax directly impacts the cost of goods sold, influencing pricing strategies and competitive positioning. Businesses must carefully navigate the complex tax system, ensuring compliance with the ever-changing regulations.

Consumer Impact

From a consumer perspective, the Sales and Use Tax adds to the overall cost of living in California. The varying tax rates across the state can influence purchasing decisions and consumer behavior. However, the tax system also ensures that essential public services and infrastructure are funded, indirectly benefiting consumers through improved quality of life and economic stability.

Compliance and Enforcement: Navigating the California Tax Landscape

Compliance with California Sales and Use Tax is a complex process, given the diverse tax rates and regulations across the state. Businesses and consumers must stay informed about the latest tax laws and regulations to ensure they meet their tax obligations accurately and on time.

Registration and Remittance

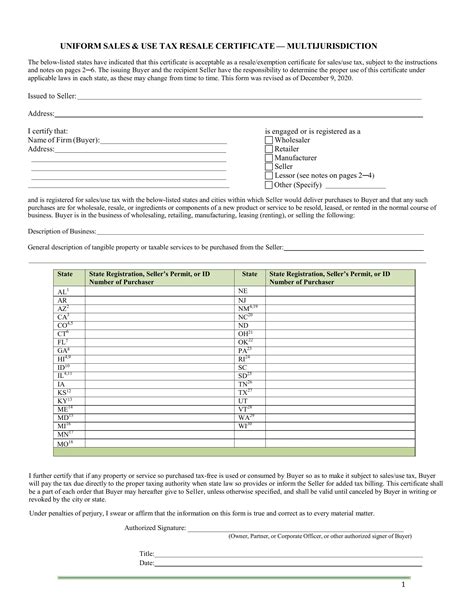

Businesses operating in California are typically required to register for a Seller’s Permit, which authorizes them to collect and remit Sales Tax on behalf of the state. The registration process involves providing detailed information about the business, including its legal structure, location, and products or services offered.

Once registered, businesses must collect the applicable Sales Tax from customers at the point of sale and remit these funds to the state on a regular basis. The frequency of remittance depends on the business's tax liability, with options ranging from monthly to annually.

Use Tax Compliance

Use Tax compliance is often more challenging, as it relies on self-assessment and reporting. Consumers and businesses that purchase goods from out-of-state vendors without paying Sales Tax are responsible for self-assessing and remitting the Use Tax. This process involves calculating the tax based on the purchase price and the applicable tax rate, then submitting the payment to the state.

Enforcement and Penalties

The California Department of Tax and Fee Administration (CDTFA) is responsible for enforcing Sales and Use Tax compliance. The department has a range of tools at its disposal, including audits, investigations, and penalties for non-compliance. Penalties can include fines, interest charges, and even criminal prosecution in cases of tax evasion.

However, the CDTFA also recognizes the complexity of the tax system and offers various resources and support to help businesses and consumers understand and meet their tax obligations. These resources include educational materials, webinars, and one-on-one assistance.

The Future of California Sales and Use Tax: Trends and Predictions

As California continues to evolve, so too will its Sales and Use Tax system. Several trends and factors are likely to shape the future of this tax system, influencing its structure, rates, and impact on the state’s economy and businesses.

Technological Advancements

The rapid pace of technological change is likely to continue shaping the Sales and Use Tax landscape. The rise of e-commerce and digital transactions presents unique challenges and opportunities for tax collection and compliance. California is likely to continue adapting its tax system to ensure equitable taxation in the digital age, potentially exploring new methods of tax collection and enforcement.

Economic Trends

Economic trends, both within California and globally, will also influence the future of Sales and Use Tax. As the state’s economy evolves, so too will its tax needs and priorities. For instance, changes in consumer spending patterns, the rise of new industries, and shifts in the job market are likely to impact the tax system’s structure and revenue allocation.

Political and Legislative Changes

Political and legislative decisions are critical drivers of Sales and Use Tax policy. As new administrations take office and new laws are passed, the tax system can undergo significant changes. These changes can range from adjustments to tax rates and exemptions to the introduction of new taxes or the revision of existing ones.

Public Perception and Advocacy

The public’s perception of Sales and Use Tax and its impact on the economy and daily life can also shape the future of the tax system. Advocacy groups, businesses, and consumers can influence tax policy through their engagement with policymakers and participation in the democratic process. This engagement can lead to reforms, adjustments, or even the repeal of certain tax measures.

What is the current Sales Tax rate in California?

+As of 2023, the state-level Sales Tax rate in California is 7.25%. However, local and district taxes can add to this rate, resulting in a combined Sales Tax rate that varies across the state.

How often do Sales Tax rates change in California?

+Sales Tax rates can change at any time, but significant rate changes are typically driven by legislative action. Local jurisdictions may also adjust their tax rates periodically, leading to variations in the combined Sales Tax rate.

Are there any Sales Tax exemptions in California?

+Yes, California offers a range of Sales Tax exemptions for specific goods and services. These exemptions can vary based on the nature of the transaction, the type of business, or the status of the purchaser. It’s essential to stay informed about these exemptions to ensure accurate tax compliance.

How can businesses stay compliant with California Sales and Use Tax regulations?

+Businesses can stay compliant by registering for a Seller’s Permit, collecting and remitting Sales Tax accurately, and staying informed about tax rate changes and exemptions. Regularly reviewing tax regulations and seeking professional advice can also help ensure compliance.

What resources are available to help with Sales and Use Tax compliance in California?

+The California Department of Tax and Fee Administration (CDTFA) provides a wealth of resources, including guides, webinars, and one-on-one assistance. Businesses and consumers can also seek advice from tax professionals and industry associations for further support and guidance.