Ca Pay Taxes

In the realm of personal finance and economic responsibilities, one topic that often sparks curiosity and raises important questions is the act of paying taxes. While it may not be the most glamorous or exciting aspect of our daily lives, understanding the ins and outs of taxation is crucial for every individual and business. This comprehensive guide aims to delve deep into the world of tax payments, exploring the various aspects, implications, and best practices associated with this essential financial obligation.

Understanding the Basics: What are Taxes and Why Do We Pay Them?

At its core, taxation is a means by which governments raise revenue to fund public services and infrastructure. Taxes are levied on individuals, businesses, and entities as a mandatory contribution to the state. This revenue is utilized to support a wide range of essential services, including education, healthcare, defense, social welfare programs, and the maintenance of public utilities.

The concept of taxation can be traced back to ancient civilizations, where rulers imposed various forms of taxes to sustain their empires. Over centuries, taxation systems have evolved, becoming more sophisticated and tailored to the needs of modern societies. Today, taxes are a fundamental pillar of economic policy, playing a crucial role in shaping the financial landscape and influencing economic growth and development.

The Importance of Compliance and Fair Taxation

Compliance with tax regulations is not merely a legal obligation; it is a civic duty that ensures the smooth functioning of our society. When individuals and businesses pay their fair share of taxes, it contributes to the overall stability and prosperity of the nation. Non-compliance, on the other hand, can lead to significant legal consequences and undermine the integrity of the system.

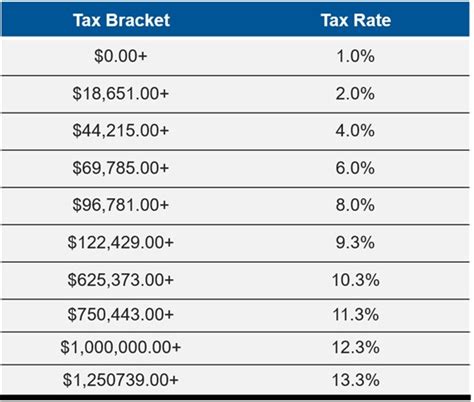

Fair taxation is a principle that ensures individuals and entities are taxed according to their ability to pay. This concept promotes equality and ensures that the burden of taxation is distributed equitably across different income levels and economic sectors. Progressive tax systems, for instance, aim to achieve this fairness by taxing higher incomes at a higher rate, while offering more relief to lower-income earners.

Types of Taxes and How They Affect Individuals

Taxes come in various forms, each serving a specific purpose and impacting individuals differently. Understanding the different types of taxes is crucial for effective financial planning and compliance.

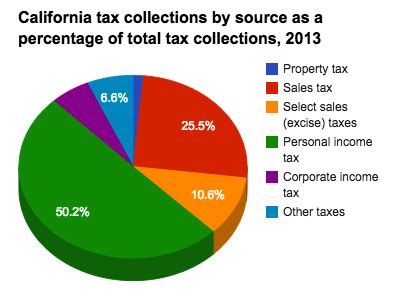

Income Taxes

Income taxes are perhaps the most well-known and widely discussed type of tax. These taxes are levied on an individual’s earnings, whether from employment, self-employment, investments, or other sources. The rate at which income is taxed varies based on the tax bracket an individual falls into. Higher earners are taxed at a higher rate, while those with lower incomes enjoy lower tax rates.

Income taxes are a significant source of revenue for governments, and they play a crucial role in funding social safety nets and public services. For individuals, effective tax planning can help optimize their tax liabilities, ensuring they pay the right amount and take advantage of available deductions and credits.

Payroll Taxes

Payroll taxes are levied on both employers and employees, primarily to fund social security and Medicare programs. These taxes are automatically deducted from an employee’s paycheck, with the employer contributing an additional amount on their behalf. Payroll taxes are a vital source of funding for retirement benefits, healthcare coverage, and disability insurance.

For employers, payroll taxes can be complex and time-consuming to manage. Outsourcing payroll services or utilizing specialized software can help streamline the process and ensure compliance with ever-changing tax regulations.

Sales and Use Taxes

Sales taxes are imposed on the sale of goods and services, while use taxes are levied on the consumption or use of certain products or services. These taxes are typically added to the retail price of goods, with the seller collecting the tax from the buyer and remitting it to the appropriate tax authority.

Sales and use taxes are a significant source of revenue for state and local governments, often funding specific projects or services. For businesses, especially those operating online or across state lines, understanding and complying with sales tax regulations can be a complex task. Staying informed about tax laws and utilizing tax calculation tools can help businesses avoid penalties and maintain compliance.

Property Taxes

Property taxes are levied on real estate and personal property, such as vehicles, boats, and aircraft. These taxes are typically based on the assessed value of the property and are used to fund local services, including schools, police and fire departments, and public works projects.

Property owners must pay their property taxes on time to avoid penalties and potential legal issues. Understanding the assessment process and staying informed about local tax rates can help property owners plan their finances effectively.

The Process of Paying Taxes: From Filing to Remittance

Paying taxes involves a series of steps, from understanding tax obligations to filing tax returns and making timely payments. Each step is crucial for ensuring compliance and avoiding penalties.

Determining Tax Obligations

The first step in the tax-paying process is understanding one’s tax obligations. This involves reviewing tax laws, regulations, and guidelines to determine the applicable taxes, tax rates, and any deductions or credits one may be eligible for. Seeking professional advice from tax experts or utilizing reliable tax preparation software can help individuals and businesses navigate this complex landscape.

Gathering Necessary Information

To accurately file tax returns, individuals and businesses must gather all relevant financial information. This includes income statements, expense records, receipts, and any other documentation related to taxable income or deductions. Proper record-keeping throughout the year can simplify this process and ensure nothing is overlooked.

Filing Tax Returns

Tax returns are formal documents that report an individual’s or business’s income, deductions, and tax liabilities for a given period. These returns must be filed within specified deadlines to avoid penalties. The filing process can be done manually or electronically, with many tax authorities offering online platforms for convenient submission.

Making Tax Payments

Once tax returns are filed, any outstanding tax liabilities must be paid. Payment methods vary depending on the tax authority and jurisdiction. Common payment methods include direct bank transfers, credit card payments, electronic funds transfer, or traditional methods like checks or money orders. Ensuring timely payments is crucial to avoid interest and penalties.

Strategies for Effective Tax Planning and Management

Tax planning is an essential aspect of financial management, allowing individuals and businesses to optimize their tax liabilities and make the most of available deductions and credits. Here are some strategies to consider:

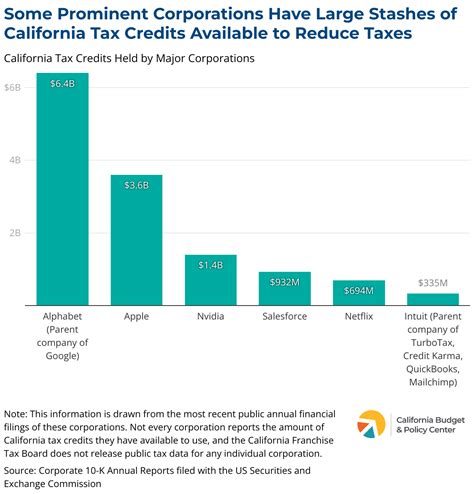

Maximizing Deductions and Credits

Taxpayers can reduce their taxable income by claiming deductions and credits for which they are eligible. Deductions reduce the amount of income subject to tax, while credits directly reduce the amount of tax owed. Common deductions include those for mortgage interest, charitable donations, business expenses, and education costs. Credits, on the other hand, can include those for childcare, education, and certain energy-efficient home improvements.

Utilizing Tax-Advantaged Accounts

Certain types of financial accounts offer tax advantages, allowing individuals to save or invest while enjoying tax benefits. Examples include retirement accounts like IRAs and 401(k)s, which offer tax-deferred or tax-free growth, and Health Savings Accounts (HSAs), which provide tax-free savings for healthcare expenses.

Understanding Tax Laws and Regulations

Staying informed about tax laws and regulations is crucial for effective tax planning. Tax codes and regulations can change frequently, so keeping abreast of these changes can help individuals and businesses avoid surprises and plan accordingly. Subscribing to tax newsletters, following reputable tax blogs, and consulting with tax professionals can ensure one stays updated.

The Impact of Taxes on the Economy and Society

Taxes play a significant role in shaping the economic landscape and influencing societal well-being. Here’s a closer look at some of these impacts:

Economic Growth and Development

Tax revenues are a primary source of funding for government initiatives aimed at economic growth and development. These funds are used to invest in infrastructure, education, research, and development, all of which contribute to a more robust and competitive economy. Well-planned tax policies can encourage investment, job creation, and economic diversification, leading to long-term prosperity.

Social Welfare and Equality

Taxation is a tool used to promote social welfare and reduce income inequality. Progressive tax systems, for instance, aim to redistribute wealth by taxing higher incomes at a higher rate. This ensures that those with greater means contribute more to support social safety nets and programs that benefit lower-income individuals and families.

International Tax Competition

In a globalized economy, countries compete to attract businesses and investment. One way they do this is by offering tax incentives and favorable tax rates. While this can stimulate economic growth, it can also lead to a race to the bottom, with countries lowering tax rates to an unsustainable level. Finding a balance between competitive tax rates and sufficient revenue generation is a delicate task for policymakers.

The Future of Taxation: Trends and Innovations

The world of taxation is constantly evolving, driven by technological advancements, changing economic landscapes, and shifting societal needs. Here are some trends and innovations shaping the future of taxation:

Digital Taxation

The rise of the digital economy has prompted tax authorities to adapt their systems to effectively tax digital businesses and transactions. This includes initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project, aimed at preventing tax avoidance by multinational enterprises. Additionally, the implementation of digital tax collection systems can streamline the tax filing and payment process, making it more efficient and secure.

Green Taxation

As the world focuses on environmental sustainability, governments are increasingly turning to taxation as a tool to promote green initiatives. This includes imposing taxes on environmentally harmful activities, such as carbon emissions, and offering tax incentives for eco-friendly practices and investments. Green taxation can encourage businesses and individuals to adopt more sustainable behaviors, contributing to a greener economy.

Blockchain and Cryptocurrency Taxation

The emergence of blockchain technology and cryptocurrencies has presented unique challenges for tax authorities. These digital assets can be difficult to track and tax effectively. However, tax authorities are developing guidelines and regulations to address this emerging field, ensuring compliance and preventing tax evasion.

Artificial Intelligence and Tax Automation

Artificial Intelligence (AI) and automation are transforming the tax landscape, making the process more efficient and accurate. AI-powered tax preparation software can analyze vast amounts of data, identify patterns, and suggest optimal tax strategies. Additionally, automated tax filing and payment systems can reduce human error and streamline the entire process.

Conclusion: The Importance of Tax Compliance and Financial Responsibility

Paying taxes is a fundamental responsibility for every individual and business. It is a critical aspect of our civic duty, ensuring the smooth functioning of our society and the provision of essential public services. While the tax landscape can be complex and ever-changing, understanding one’s tax obligations and staying informed about tax laws is crucial for compliance and financial well-being.

By embracing effective tax planning, utilizing available tax advantages, and staying informed about tax innovations, individuals and businesses can optimize their financial strategies and contribute to a more prosperous and sustainable future. Tax compliance is not just a legal requirement; it is a cornerstone of a well-functioning society and a thriving economy.

How often should I review my tax obligations and strategies?

+It’s important to review your tax obligations and strategies at least once a year, preferably during the off-season when tax deadlines are not imminent. This allows you to stay updated with any changes in tax laws and regulations and plan your finances accordingly. Additionally, major life changes, such as getting married, having children, or starting a business, should trigger a review of your tax situation.

What are some common mistakes to avoid when paying taxes?

+Some common mistakes to avoid include failing to report all income, neglecting to claim eligible deductions and credits, missing filing deadlines, and not keeping proper records. It’s also important to be cautious of tax scams and to only work with reputable tax professionals or software.

How can I stay updated with tax laws and regulations?

+Staying informed about tax laws and regulations can be done by subscribing to tax newsletters, following reputable tax blogs, and consulting with tax professionals. Additionally, government websites often provide updated information on tax laws and regulations. It’s important to verify the source of your information to ensure accuracy.