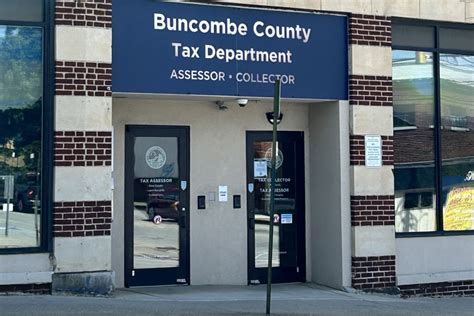

Buncombe County Tax Department

The Buncombe County Tax Department plays a crucial role in the financial landscape of Buncombe County, North Carolina. This department, often referred to as the Buncombe County Tax Office or the Buncombe County Tax Assessor's Office, is responsible for assessing property taxes, collecting revenues, and ensuring equitable taxation for the county's residents and businesses. In this comprehensive article, we will delve into the workings of the Buncombe County Tax Department, exploring its functions, services, and the impact it has on the local community.

Understanding the Role of the Buncombe County Tax Department

The Buncombe County Tax Department is a vital governmental entity, entrusted with the task of maintaining a fair and efficient tax system. Its primary objective is to ensure that all taxable properties within the county are accurately assessed and appropriately taxed, contributing to the overall revenue stream of Buncombe County.

The department's functions can be broadly categorized into three main areas: property assessment, tax collection, and taxpayer services. Each of these areas involves intricate processes and dedicated personnel, working together to uphold the integrity of the tax system and provide valuable services to the community.

Property Assessment: Ensuring Fair Taxation

One of the most critical roles of the Buncombe County Tax Department is property assessment. This process involves determining the value of real estate properties within the county, which forms the basis for calculating property taxes. The assessment process is complex and requires a high level of expertise and accuracy.

The department employs a team of professional appraisers who conduct thorough evaluations of properties. They consider various factors, including the property's location, size, age, condition, and recent sales data of similar properties. By analyzing these elements, they arrive at an estimated fair market value for each property.

This assessed value is then used to calculate the property taxes owed by the owner. The tax rate, which is determined by the Buncombe County Board of Commissioners, is applied to the assessed value to arrive at the final tax amount. This process ensures that property owners pay their fair share, contributing to the county's overall revenue and funding essential services like schools, infrastructure, and public safety.

| Assessment Year | Total Assessed Value (in millions) |

|---|---|

| 2022 | $11.2 billion |

| 2021 | $10.8 billion |

| 2020 | $10.5 billion |

Tax Collection: Efficient Revenue Generation

Once property assessments are completed, the Buncombe County Tax Department shifts its focus to tax collection. This process involves sending out tax bills to property owners, managing payment options, and ensuring timely collection of revenues.

Tax bills are typically sent out annually, detailing the assessed value of the property, the applicable tax rate, and the total amount due. Property owners have various payment options, including online payments, mail-in checks, and in-person payments at the tax office. The department also offers convenient payment plans for those who may need assistance in managing their tax obligations.

Efficient tax collection is vital for the county's financial stability and the provision of essential services. The revenue generated from property taxes funds a wide range of initiatives, including education, healthcare, public transportation, and community development projects. It is a key component of the county's budget and ensures the continuous improvement of Buncombe County's infrastructure and quality of life.

Taxpayer Services: Support and Assistance

The Buncombe County Tax Department recognizes the importance of providing excellent taxpayer services. This aspect of their work involves offering assistance, resources, and support to property owners and taxpayers.

The department maintains a taxpayer assistance center, where residents can receive personalized help with their tax-related queries. Whether it's understanding their tax bill, seeking clarification on assessment values, or exploring tax relief options, the taxpayer assistance team is equipped to provide guidance and support.

Additionally, the department offers a range of online services and resources. Property owners can access their account information, view assessment details, and make payments through the department's secure online portal. This digital platform enhances convenience and accessibility, allowing taxpayers to manage their obligations from the comfort of their homes.

Furthermore, the Buncombe County Tax Department actively engages with the community through educational workshops and outreach programs. These initiatives aim to empower taxpayers with knowledge about the tax system, assessment processes, and their rights and responsibilities. By fostering a culture of transparency and understanding, the department strengthens its relationship with the community and ensures a more collaborative approach to taxation.

Impact on the Buncombe County Community

The work of the Buncombe County Tax Department has a profound impact on the local community. Beyond the revenue generation and equitable taxation, the department’s efforts contribute to the overall well-being and development of the county.

Funding Essential Services

Property taxes collected by the Buncombe County Tax Department are a primary source of funding for essential public services. These revenues support the operation of schools, ensuring that students have access to quality education and resources. They also contribute to the maintenance and improvement of public infrastructure, such as roads, bridges, and utilities.

Furthermore, property taxes play a crucial role in funding public safety initiatives. They support the work of law enforcement agencies, fire departments, and emergency response teams, ensuring the safety and security of the community. The tax revenues also extend to healthcare services, helping to provide accessible and affordable medical care to residents.

Community Development and Revitalization

The Buncombe County Tax Department’s work extends beyond the collection of taxes. It actively participates in community development and revitalization efforts. Through strategic partnerships and initiatives, the department contributes to the growth and improvement of the county’s neighborhoods and commercial areas.

For instance, the department may collaborate with local businesses and developers to encourage economic growth and investment. It may offer tax incentives or special assessment districts to stimulate development and create jobs. By fostering a business-friendly environment, the department attracts new businesses and retains existing ones, boosting the local economy and creating opportunities for residents.

Additionally, the department works closely with community organizations and non-profits to address specific needs and challenges. It may provide funding or support for affordable housing initiatives, social services, and community-based projects. These efforts enhance the quality of life for residents and create a sense of community pride and engagement.

Accountability and Transparency

The Buncombe County Tax Department operates with a strong commitment to accountability and transparency. It maintains open communication channels with taxpayers and provides regular updates on tax policies, assessment processes, and budget allocations. This transparency builds trust and ensures that taxpayers understand how their contributions are utilized.

The department also encourages public participation and feedback. It hosts public hearings, conducts surveys, and engages with community leaders to gather input on tax-related matters. By incorporating community perspectives, the department can make informed decisions that align with the needs and aspirations of Buncombe County residents.

Future Outlook and Innovations

As the landscape of taxation and technology continues to evolve, the Buncombe County Tax Department is committed to staying at the forefront of innovation. The department recognizes the importance of adapting to changing times to enhance efficiency, accessibility, and taxpayer satisfaction.

Digital Transformation

The Buncombe County Tax Department is actively embracing digital transformation to streamline its processes and enhance taxpayer experiences. The department is investing in modern technology and digital tools to improve efficiency and reduce administrative burdens.

For instance, the department is implementing advanced data analytics and artificial intelligence to optimize assessment processes. These technologies enable more accurate and timely property evaluations, reducing the likelihood of errors and disputes. Additionally, the department is exploring blockchain technology to enhance data security and transparency, ensuring that taxpayer information remains confidential and protected.

Tax Relief Programs and Incentives

The Buncombe County Tax Department is dedicated to supporting taxpayers, especially those facing financial hardships or unique circumstances. The department offers a range of tax relief programs and incentives to ease the burden on eligible residents.

One such initiative is the Property Tax Deferral Program, which allows eligible seniors and disabled individuals to defer their property taxes until the property is sold or transferred. This program provides much-needed financial relief for those on fixed incomes or facing health challenges. The department also offers homestead exemptions, reducing property taxes for primary residents, and encourages the development of affordable housing through tax incentives.

Community Engagement and Education

The Buncombe County Tax Department recognizes the value of community engagement and education in fostering a positive relationship with taxpayers. The department actively participates in community events, workshops, and outreach programs to educate residents about their tax obligations and rights.

By providing clear and concise information, the department empowers taxpayers to make informed decisions and understand the impact of their contributions. These educational efforts also help dispel misconceptions and address common concerns, creating a more collaborative and understanding environment.

Continuous Improvement and Best Practices

The Buncombe County Tax Department is committed to continuous improvement and the adoption of best practices in taxation. The department regularly reviews its processes, policies, and procedures to identify areas for enhancement and implement innovative solutions.

Through collaboration with other tax departments and industry experts, the department stays abreast of the latest trends and advancements in taxation. This commitment to continuous improvement ensures that the Buncombe County Tax Department remains a leader in its field, delivering exceptional services and contributing to the prosperity of the community.

How often are property assessments conducted in Buncombe County?

+Property assessments in Buncombe County are conducted every eight years. This revaluation process ensures that property values remain accurate and up-to-date.

What payment options are available for property taxes in Buncombe County?

+Property owners in Buncombe County have several payment options, including online payments, mail-in checks, and in-person payments at the tax office. The department also offers convenient payment plans for those who need assistance.

How can I contact the Buncombe County Tax Department for assistance?

+The Buncombe County Tax Department can be reached through various channels. You can visit their website for online resources and contact information. Additionally, you can call their taxpayer assistance center during business hours or schedule an appointment for personalized help.

What are the tax relief programs offered by the Buncombe County Tax Department?

+The Buncombe County Tax Department offers several tax relief programs, including the Property Tax Deferral Program for seniors and disabled individuals, homestead exemptions for primary residents, and tax incentives for affordable housing development.

How does the Buncombe County Tax Department ensure transparency and accountability?

+The Buncombe County Tax Department prioritizes transparency and accountability through open communication, regular updates on tax policies, and public engagement. They host public hearings, conduct surveys, and actively seek community input to ensure that taxpayer concerns are addressed.