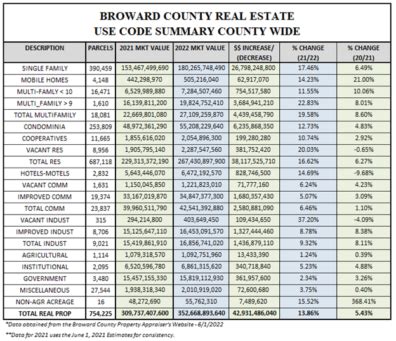

Broward County Real Estate Taxes

Broward County, Florida, is renowned for its vibrant communities, diverse neighborhoods, and thriving real estate market. Property taxes are an essential aspect of homeownership, and understanding how they work and their implications is crucial for residents and investors alike. This comprehensive guide delves into the world of Broward County real estate taxes, shedding light on the tax system, rates, exemptions, and strategies to navigate this crucial aspect of homeownership effectively.

The Broward County Tax System: A Comprehensive Overview

The tax system in Broward County operates under a structured framework governed by the Florida Constitution and the Florida Statutes. These legal foundations outline the responsibilities and authorities of the Broward County Property Appraiser, Tax Collector, and Board of County Commissioners in matters related to property assessments, tax rates, and collection.

The Property Appraiser's primary role is to assess the value of all taxable properties within the county, ensuring fairness and accuracy in the process. This value, known as the "Just Value", forms the basis for calculating property taxes. The Tax Collector, on the other hand, is responsible for collecting these taxes and distributing them to various taxing authorities, including the county, cities, and special districts.

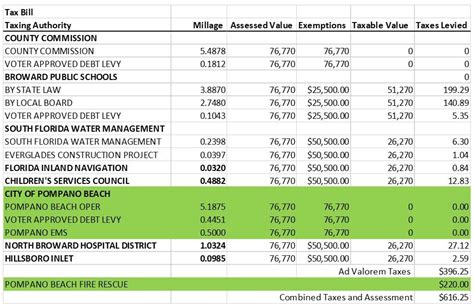

The millage rate, a critical component of the tax system, is determined annually by the Board of County Commissioners and other taxing authorities. This rate, expressed in mills (where one mill equals $1 of tax for every $1,000 of assessed value), is applied to the Just Value to calculate the property tax owed.

For instance, if a property's Just Value is assessed at $250,000 and the millage rate is set at 15 mills, the property tax calculation would be as follows:

| Just Value | $250,000 |

|---|---|

| Millage Rate | 15 mills |

| Property Tax Owed | $3,750 |

In this example, the property owner would owe $3,750 in real estate taxes for the year.

It's important to note that the millage rate can vary based on the location of the property within the county and the services it receives. For instance, properties in unincorporated Broward County may have a different millage rate than those within city limits, reflecting the specific services and infrastructure provided by each jurisdiction.

Understanding Tax Exemptions and Discounts

Broward County offers a range of tax exemptions and discounts aimed at providing relief to eligible homeowners. These incentives can significantly reduce the property tax burden, making homeownership more affordable.

Homestead Exemption

The Homestead Exemption is one of the most well-known and widely utilized tax benefits in Florida. It provides a discount on the assessed value of a primary residence, effectively reducing the property tax bill. To qualify for the Homestead Exemption, homeowners must meet certain criteria, including:

- Legal residency in Florida for at least six months prior to applying.

- Ownership of the property as their primary residence.

- Application submission by March 1st of the year for which the exemption is sought.

The Homestead Exemption offers a substantial reduction in taxable value, typically $25,000 or more, depending on the property's Just Value. For instance, a property with a Just Value of $300,000 would have its taxable value reduced to $275,000 with the Homestead Exemption applied.

Additional Exemptions and Discounts

Beyond the Homestead Exemption, Broward County offers a variety of other exemptions and discounts, including:

- Senior Exemption: Available to homeowners aged 65 or older, this exemption provides a discount on the assessed value of the property, similar to the Homestead Exemption.

- Widow/Widower Exemption: This exemption benefits surviving spouses of military personnel or first responders who died in the line of duty.

- Veterans' Discount: Active-duty military personnel and veterans may be eligible for a discount on their property taxes.

- Low-Income Senior Discount: Aimed at low-income seniors, this discount reduces the property tax burden further.

It's essential for homeowners to explore all available exemptions and discounts to maximize their tax savings. Each exemption has its own eligibility criteria and application process, which can be found on the Broward County Property Appraiser's website or by contacting the office directly.

Navigating the Tax Assessment Process

The property tax assessment process in Broward County is a meticulous endeavor, ensuring that all taxable properties are accurately valued. The Property Appraiser’s office undertakes this task annually, using a combination of on-site inspections, sales data analysis, and other valuation methods.

The Assessment Notice

Homeowners in Broward County receive an annual Assessment Notice, which details the assessed value of their property and the associated taxes. This notice is typically mailed out in early November and provides a comprehensive breakdown of the property’s characteristics, such as size, improvements, and exemptions applied.

If a homeowner disagrees with the assessed value or believes an error has been made, they have the right to appeal. The Assessment Notice will provide instructions on how to initiate an appeal, including deadlines and the necessary documentation.

Appealing Your Assessment

The appeals process in Broward County is designed to be accessible and fair. Homeowners can choose to file an informal appeal, which involves a review of the assessment by the Property Appraiser’s office, or a formal appeal, which is heard by the Value Adjustment Board (VAB). The VAB is an independent board responsible for resolving disputes related to property assessments.

To initiate an informal appeal, homeowners should contact the Property Appraiser's office within 25 days of receiving the Assessment Notice. The office will then conduct a review and provide a decision, which can be further appealed to the VAB if the homeowner is not satisfied.

The formal appeal process involves filing a petition with the VAB, typically within 60 days of the Assessment Notice. The VAB will schedule a hearing, during which the homeowner can present their case and provide evidence to support their appeal. It's advisable to seek professional guidance or legal counsel when navigating the formal appeal process.

Strategies for Effective Tax Management

Navigating the complexities of real estate taxes requires a strategic approach. Here are some strategies homeowners can employ to manage their property taxes effectively:

Stay Informed

Understanding the tax system, rates, and exemptions is crucial. Stay updated on any changes or new incentives by regularly checking the Broward County Property Appraiser’s website and following local news sources.

Maximize Exemptions

Ensure you’re taking advantage of all available exemptions and discounts. Review your eligibility for the Homestead Exemption annually, and explore other exemptions that may apply to your situation.

Monitor Assessments

Pay close attention to your annual Assessment Notice. If you notice any discrepancies or believe the assessed value is inaccurate, consider appealing. Regularly monitoring your property’s value can help identify potential issues and ensure fair taxation.

Consider Property Improvements

While improvements can increase the assessed value of your property, they can also enhance its overall value and appeal. Assess the potential tax implications of any planned improvements and weigh them against the benefits they bring to your home.

Utilize Professional Guidance

Tax laws and regulations can be complex, and navigating them on your own can be challenging. Consider seeking advice from tax professionals or real estate attorneys who specialize in property taxes. They can provide valuable insights and ensure you’re optimizing your tax strategies.

The Impact of Real Estate Taxes on the Community

Real estate taxes play a pivotal role in shaping the community’s future and infrastructure. The revenue generated from property taxes is distributed among various taxing authorities, each with its own responsibilities and services to provide.

For instance, the county's portion of the tax revenue funds essential services like law enforcement, emergency response, and infrastructure maintenance. Cities and special districts use their share to support local services, such as parks, libraries, and community centers. This collaborative funding model ensures that the community's needs are met and that residents receive the services they require.

A Community Investment

Paying real estate taxes is not just a financial obligation but also an investment in the community. The tax revenue supports the development and maintenance of vital infrastructure, enhances public safety, and contributes to the overall well-being of the residents. It’s a collective effort that strengthens the community and improves the quality of life for everyone.

By understanding the tax system and actively participating in the process, homeowners can ensure that their tax contributions are used efficiently and effectively. It's a responsibility shared by all residents, and by staying informed and engaged, homeowners can play a vital role in shaping the future of their community.

When is the deadline to apply for the Homestead Exemption in Broward County?

+

The deadline to apply for the Homestead Exemption is March 1st of the year for which the exemption is sought. It’s important to note that if you miss this deadline, you may still be eligible for the exemption the following year, but you’ll need to apply again.

How often are property assessments conducted in Broward County?

+

Property assessments are conducted annually in Broward County. The Property Appraiser’s office undertakes a comprehensive review of all taxable properties to ensure fair and accurate valuations.

Can I appeal my property assessment if I disagree with the value assigned?

+

Yes, if you disagree with your property’s assessed value, you have the right to appeal. Broward County offers both informal and formal appeal processes. An informal appeal involves a review by the Property Appraiser’s office, while a formal appeal is heard by the Value Adjustment Board (VAB). It’s important to follow the timelines and procedures outlined in your Assessment Notice.

What happens if I don’t pay my real estate taxes in Broward County?

+

Unpaid real estate taxes can lead to significant consequences. The Tax Collector’s office may impose penalties and interest on the outstanding balance, and if the taxes remain unpaid, the property could be subject to a tax certificate sale or foreclosure.

Are there any tax relief programs for low-income homeowners in Broward County?

+

Yes, Broward County offers the Low-Income Senior Discount, which provides additional tax relief for low-income seniors. To be eligible, homeowners must be aged 65 or older and meet certain income criteria. This discount can further reduce the property tax burden for eligible individuals.