Anchorage Muni Property Tax

Property taxes are an essential part of the financial landscape for homeowners and property owners across the United States. These taxes contribute to the revenue streams of local governments and municipalities, funding various public services and infrastructure. In this article, we delve into the specifics of property taxes in Anchorage, Alaska, focusing on the unique aspects of the Anchorage Municipal Property Tax system.

Understanding Anchorage’s Property Tax Structure

Anchorage, the largest city in Alaska, has a robust property tax system that supports the city’s operations and development. The Anchorage Municipal Property Tax is levied on both residential and commercial properties within the municipality’s boundaries. This tax plays a crucial role in funding essential services such as education, public safety, transportation, and municipal maintenance.

The tax system in Anchorage operates under a mill rate, which is a common method used by many municipalities across the country. The mill rate, expressed in mills (where one mill equals one-tenth of a cent), determines the tax liability for property owners. This rate is applied to the assessed value of the property, resulting in the final tax amount.

For instance, if the mill rate in Anchorage is set at 15 mills, and a homeowner's property is assessed at a value of $200,000, the property tax calculation would be as follows: $200,000 x 0.015 = $3,000. Thus, the homeowner would owe $3,000 in municipal property taxes for that year.

Assessed Value and Tax Rates

The assessed value of a property is determined by the Anchorage Municipal Assessor’s Office, which conducts regular evaluations to ensure fairness and accuracy. These assessments consider various factors such as the property’s size, location, improvements, and market conditions.

The mill rate, on the other hand, is set annually by the Anchorage Municipal Assembly, the governing body of the municipality. The assembly takes into account the budget requirements of the city, the need for funding public services, and the overall economic climate when determining the tax rate.

It's important to note that Anchorage's property tax system is designed to be progressive, meaning that higher-value properties contribute a larger proportion of their assessed value in taxes. This approach aims to ensure that the tax burden is distributed fairly across different income levels and property values.

| Tax Year | Mill Rate | Average Assessed Value |

|---|---|---|

| 2023 | 15.2 mills | $210,000 |

| 2022 | 14.8 mills | $205,000 |

| 2021 | 14.5 mills | $190,000 |

As shown in the table, the mill rate in Anchorage has seen a slight increase over the past few years, reflecting the growing needs and expenses of the municipality. Meanwhile, the average assessed value of properties has also been on an upward trend, indicating a generally healthy real estate market.

Property Tax Exemptions and Discounts

Recognizing the diverse needs of its residents, Anchorage offers several property tax exemptions and discounts to eligible homeowners and property owners. These incentives aim to reduce the tax burden for specific groups and encourage certain behaviors or initiatives.

Homestead Exemption

One of the most notable exemptions is the Homestead Exemption, which provides a reduction in the assessed value of a primary residence. To qualify for this exemption, homeowners must meet certain residency requirements and occupy the property as their principal residence. The exemption amount is typically a percentage of the property’s assessed value, and it can significantly reduce the tax liability for eligible homeowners.

Senior Citizen Exemption

Anchorage also offers a Senior Citizen Exemption, designed to provide relief to homeowners aged 65 and older. This exemption reduces the taxable value of the property, thus lowering the overall property tax. To qualify, seniors must meet residency and income requirements, ensuring that the exemption benefits those who need it most.

Veteran’s Exemption

As a token of appreciation for their service, Anchorage provides a Veteran’s Exemption to eligible military veterans. This exemption reduces the assessed value of the veteran’s primary residence, leading to a lower property tax bill. The municipality aims to honor the sacrifices made by veterans by offering this financial relief.

Green Building Incentives

In an effort to promote sustainability and energy efficiency, Anchorage has introduced Green Building Incentives. Property owners who construct or retrofit their buildings to meet certain green standards can receive a reduction in their property’s assessed value. This initiative not only encourages environmentally friendly practices but also rewards property owners for their commitment to sustainability.

| Exemption Type | Eligibility Criteria | Reduction in Taxable Value |

|---|---|---|

| Homestead Exemption | Primary residence, residency requirements | Up to 20% of assessed value |

| Senior Citizen Exemption | Age 65+, residency and income requirements | 10% of assessed value |

| Veteran's Exemption | Military veteran, primary residence | 5% of assessed value |

| Green Building Incentive | Meets green building standards | Varies based on certification level |

These exemptions and incentives showcase Anchorage's commitment to supporting its residents and encouraging positive behaviors. By offering tax relief to eligible groups and promoting sustainable practices, the municipality demonstrates its forward-thinking approach to property taxation.

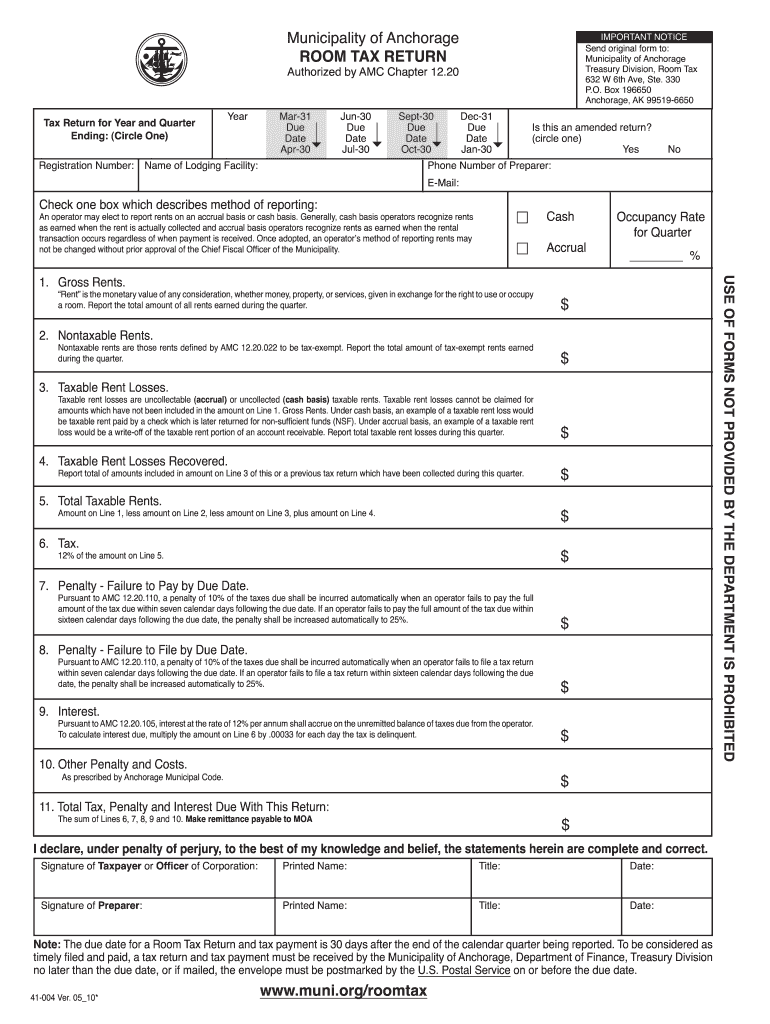

Payment Options and Due Dates

The Anchorage Municipal Property Tax is typically due twice a year, with payments usually made in June and December. Property owners have several options to settle their tax liabilities, ensuring convenience and flexibility.

Online Payment

Anchorage provides a user-friendly online platform where taxpayers can access their property tax information and make secure payments. This option is convenient for those who prefer digital transactions and offers a quick and efficient way to settle tax bills.

Mail-In Payment

For those who prefer a more traditional method, Anchorage accepts mail-in payments. Property owners can send their payment, along with the appropriate form, to the designated address. This option provides a sense of security and privacy for those who are not comfortable with online transactions.

In-Person Payment

The Anchorage Municipal Treasury office also accepts in-person payments. Taxpayers can visit the office during business hours and make their payments in person. This option allows for direct interaction with tax officials and can be beneficial for those who have questions or need assistance with their tax obligations.

It's worth noting that late payments may incur penalties and interest, so it's essential for property owners to stay informed about the due dates and ensure timely payments to avoid additional charges.

Tax Payment Plans

Understanding that unexpected circumstances can arise, Anchorage offers Tax Payment Plans to assist property owners who may struggle to pay their taxes in full. These plans allow taxpayers to pay their taxes in installments, making it more manageable to settle their obligations. The municipality works closely with taxpayers to set up suitable payment schedules, ensuring that everyone has an opportunity to meet their tax responsibilities.

Conclusion: A Fair and Progressive Tax System

The Anchorage Municipal Property Tax system is designed to be fair and equitable, considering the diverse needs and circumstances of its residents. By implementing a progressive tax structure and offering a range of exemptions and incentives, the municipality ensures that the tax burden is distributed fairly and encourages positive behaviors and initiatives.

From supporting seniors and veterans to promoting sustainability, Anchorage's property tax system demonstrates its commitment to the well-being and growth of the community. By providing clear guidelines, flexible payment options, and supportive initiatives, the municipality fosters a positive relationship with its taxpayers, ensuring that property ownership is a rewarding experience for all.

How often are property taxes assessed in Anchorage?

+

Property taxes in Anchorage are assessed annually. The assessment takes into account various factors such as property value, location, and improvements made to the property.

Are there any penalties for late property tax payments in Anchorage?

+

Yes, late payments of property taxes in Anchorage may incur penalties and interest. It is important to stay informed about the due dates and make timely payments to avoid additional charges.

Can I appeal my property tax assessment in Anchorage?

+

Absolutely! If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal. The Anchorage Municipal Assessor’s Office provides guidelines and procedures for filing an appeal. It’s important to review the assessment carefully and gather any relevant evidence to support your case.