Aiken County Property Tax

Welcome to this comprehensive guide on Aiken County's property tax system. Property taxes are an essential part of the local government's revenue stream, funding vital services and infrastructure development. In this article, we will delve into the specifics of Aiken County's property tax assessment, rates, exemptions, and payment processes, providing you with an in-depth understanding of this crucial aspect of homeownership.

Understanding Aiken County’s Property Tax Assessment

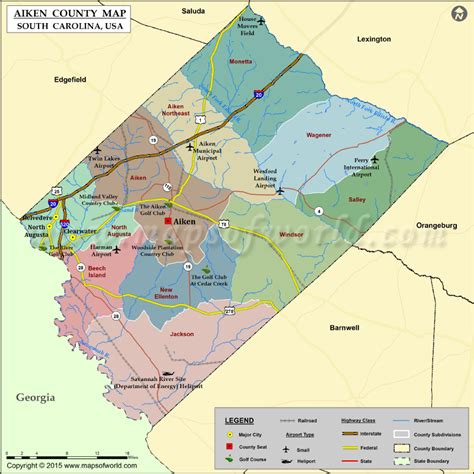

Aiken County, located in the beautiful state of South Carolina, has a well-defined property tax assessment process. The county’s tax assessor’s office plays a pivotal role in determining the taxable value of properties within its jurisdiction. This value is derived from a combination of factors, including the property’s location, size, improvements, and recent sales data.

The assessment process is designed to be fair and equitable, ensuring that each property owner pays their fair share of taxes. The county employs experienced assessors who conduct thorough inspections and utilize advanced valuation techniques to accurately assess the market value of properties. This valuation process is updated regularly to reflect the dynamic real estate market.

For instance, let's consider the case of a residential property in downtown Aiken. The assessor would take into account the property's square footage, the number of bedrooms and bathrooms, any recent renovations or additions, and the overall condition of the property. They would also consider the recent sale prices of similar properties in the area to ensure an accurate assessment.

| Assessment Factor | Description |

|---|---|

| Location | Properties in prime locations with desirable amenities may have higher assessments. |

| Size and Improvements | Larger properties or those with significant improvements may incur higher valuations. |

| Market Data | Recent sales of comparable properties influence the assessment process. |

Property Tax Rates and Exemptions

Once the taxable value of a property is determined, it is subjected to the applicable tax rate, which is set by Aiken County’s governing body. The tax rate is expressed as “mills,” where one mill equals 1 of tax for every 1,000 of assessed value. The county’s tax rate is typically comprised of a combination of county, school district, and special district taxes.

For the 2023 tax year, Aiken County's millage rate was set at 100.5 mills, comprising 52.8 mills for county operations, 41.4 mills for schools, and 6.3 mills for special districts. This rate may vary slightly from year to year based on budgetary needs and voter-approved initiatives.

To illustrate, if a homeowner has a property with an assessed value of $200,000, their annual property tax bill would be calculated as follows: $200,000 x 0.1005 (millage rate) = $2,010. This means the homeowner would owe $2,010 in property taxes for the year.

Aiken County also offers various exemptions to reduce the tax burden for eligible property owners. These exemptions include:

- Homestead Exemption: Provides a reduction in taxable value for primary residences, benefiting homeowners with limited incomes.

- Veterans' Exemption: Offers a tax break to honorably discharged veterans and their surviving spouses, reducing their taxable value.

- Senior Citizen Exemption: Aids senior citizens by reducing their taxable value based on specific criteria.

- Disability Exemption: Assists individuals with disabilities by exempting a portion of their property's value from taxation.

For example, a senior citizen homeowner who qualifies for the Senior Citizen Exemption may have their property's taxable value reduced by $50,000. This reduction directly lowers their annual property tax obligation.

Property Tax Payment Process

Aiken County provides a user-friendly system for property tax payments. Tax bills are typically mailed to property owners in October, detailing the assessed value, applicable tax rates, and the total amount due. Homeowners have the option to pay their taxes in full or choose to make semi-annual payments.

The county accepts various payment methods, including online payments through their official website, mail-in checks, and in-person payments at designated locations. To ensure a smooth process, the county provides clear instructions and due dates on the tax bills. Late payments may incur penalties and interest, so it's important for homeowners to stay informed and meet the payment deadlines.

Additionally, Aiken County offers a convenient payment plan for homeowners who may face financial difficulties. This plan allows eligible homeowners to spread their tax payments over multiple installments, making it more manageable to meet their tax obligations.

The Impact of Property Taxes on Local Development

Property taxes play a crucial role in funding essential services and driving local development in Aiken County. A significant portion of the tax revenue goes towards maintaining and improving the county’s infrastructure, including roads, bridges, and public facilities. It also supports vital services such as emergency response, law enforcement, and education.

For instance, property tax revenue has been instrumental in the recent renovation of several schools in the county, providing modern learning environments for students. Additionally, it has funded the expansion of the county's public library system, offering enhanced resources and services to the community.

Moreover, property taxes contribute to the overall economic growth of Aiken County. The revenue generated supports local businesses, attracts new investments, and creates job opportunities. It also helps fund initiatives aimed at promoting tourism and cultural development, further enhancing the county's appeal.

Conclusion

Aiken County’s property tax system is a critical component of the local government’s financial structure, ensuring the county’s continued growth and development. By understanding the assessment process, tax rates, and exemptions, property owners can effectively manage their tax obligations and contribute to the community’s prosperity. The county’s transparent and accessible tax payment processes further enhance the homeowner’s experience.

As a responsible homeowner in Aiken County, staying informed about property taxes is essential. By staying up-to-date with tax assessments, rates, and payment deadlines, you can plan your finances effectively and ensure your contribution to the community's well-being.

How often are property tax assessments conducted in Aiken County?

+Property tax assessments in Aiken County are conducted annually to ensure the tax burden is fair and up-to-date. The assessor’s office reviews and adjusts property values based on market trends and other relevant factors.

Can I appeal my property tax assessment if I believe it is inaccurate?

+Absolutely! Aiken County provides a formal appeals process for property owners who disagree with their assessment. The process typically involves submitting an appeal within a specified timeframe and providing evidence to support your claim.

Are there any property tax breaks or exemptions for energy-efficient homes?

+Yes, Aiken County offers an Energy Efficiency Tax Credit for properties that meet certain energy-efficient standards. This credit can reduce your taxable value, resulting in lower property taxes. Contact the tax assessor’s office for more details and eligibility criteria.

What happens if I fail to pay my property taxes on time?

+Late payment of property taxes can result in penalties and interest charges. If the taxes remain unpaid for an extended period, the county may initiate legal proceedings, which could lead to the sale of the property to recover the outstanding taxes.